The street is jittery. First quarter earnings reports are in. The first quarter of 2010 was a period of market volatility. Who are the big winners? Who are the big losers? The metagame at the close of 2009 was extremely diverse, with a variety of strong offerings. The printings from Worldwake shook up the marketplace. I’m here to help you sort it all out. This report will describe trends in the Vintage market, including the profitability of each major archetype, with buy/sell recommendations by archetype for investments in the Q2 of 2010.

Vintage players do not have the benefit of large-scale events like Pro Tours and Grands Prix to set the metagame and inform players what the top decks are. Vintage is far more decentralized. Nonetheless, there are clear trends and emergent patterns in the Vintage metagame market.

In this market report I aggregate the results of every 33+ player Vintage tournament reported anywhere on the planet into one simple, easily accessible report. Tournaments with fewer than 33 players are excluded so that each top 8 statistic represents a player that has played in six rounds of swiss, and faced at least four different opponents in combat. This gives us confidence that the top 8 data reflects decks that succeed against diverse opposition and not simply a few lucky pairings.

There were a healthy 20 Vintage tournaments with 33 or more players reported in the first quarter of 2010, for a total of 160 of possible Top 8 slots. The average number of players was 55 per tournament. Metagame market conditions are generally strong. The tournament data comes from a diversity of regions. Eight of the 20 tournament results are American, 1 is Canadian, 4 are from Spain or thereabouts, 2 are Italian, 2 are Swiss, 2 are Dutch, and 1 is Pilipino. In short, 9 of the 20 tournaments are North American, 10 are European, and 1 is east Asian. This should give us a good sense of the global market. (See the Appendix for links.)

Creatures (1)

Planeswalkers (3)

Lands (9)

Spells (47)

- 1 Sensei's Divining Top

- 1 Brainstorm

- 4 Mana Drain

- 1 Vampiric Tutor

- 1 Mystical Tutor

- 1 Yawgmoth's Will

- 4 Force of Will

- 1 Mana Vault

- 1 Sol Ring

- 1 Demonic Tutor

- 1 Hurkyl's Recall

- 7 Island

- 1 Time Walk

- 1 Ancestral Recall

- 1 Mana Crypt

- 1 Time Vault

- 1 Gifts Ungiven

- 1 Merchant Scroll

- 1 Thirst for Knowledge

- 1 Echoing Truth

- 1 Tinker

- 1 Rebuild

- 1 Voltaic Key

- 1 Black Lotus

- 1 Fact or Fiction

- 1 Mox Emerald

- 1 Mox Jet

- 1 Mox Pearl

- 1 Mox Ruby

- 1 Mox Sapphire

- 1 Mindbreak Trap

- 4 Spell Pierce

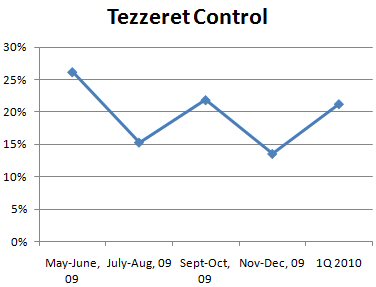

This trend line charts Tezzeret Control as a percentage of Vintage tournament Top 8s from May/June, 2009 through the first quarter of 2010. Tezzeret currently has the greatest Top 8 market share in the format. In the previous Market report I advised investors to buy this stock. Tezzeret experienced a whopping 56% growth in metagame market share from November-December through the 1Q, 2010, rising from a historic low 13.54% of the Top 8 field to 21.25%.

Tezzeret Control is the format’s premiere Mana Drain-based Control deck. Its primary strategy is to take infinite turns with Time Vault, using either Voltaic Key or Tezzeret the Planeswalker to untap Time Vault. It takes control of the game and protects this strategy with the permission trifecta of Force of Will, Mana Drain, and more recently, Spell Pierce. For a control deck, Tezzeret can be quite explosive. It abuses the format’s artifact acceleration to fuel draw spells and quickly manipulate its’ library. Tutors such as Vampiric Tutor, Demonic Tutor and Gifts Ungiven help it assemble the Time Vault combo. It also uses Tinker and either Darksteel Colossus, Inkwell Leviathan, or Sphinx of the Steel Wind as a quick secondary win condition. Yawgmoth’s Will serves as a strategic finisher, by generating insurmountable card advantage. That’s pretty much everything the deck does.

Tezzeret first emerged as a Vintage archetype with the virtually simultaneous printing of Tezzeret the Seeker in Shards of Alara and removal of power level errata on Time Vault in the fall of 2008. In its first months Tezzeret became the format’s best performing archetype, with 25% of Top 8s. It continued to outperform the field until the DCI (the format’s central bank) restricted Thirst For Knowledge in June, 2009. Subsequently, its performance has fluctuated in a range markedly below its historic pre-restriction highs, as you can see from the chart above. Many feared that the restriction of Thirst would fail to curb Tezzeret’s format dominance. This fear has proven unwarranted, as the restriction of Thirst has had a clear impact on Tezzeret’s overall performance, which has been strong, but inconsistent.

As you can see from the trend line above, since the restriction of Thirst, Tezzeret has fluctuated in an oscillating pattern. Post-restriction, Tezzeret fell to 15% of top 8s, then regained some market share and climbed to 22%. Then, in November-December it fell again to 14%, and climbed back to 21%. In short, Tezzeret has stayed within the 14-22% range of Vintage Top 8s in the 10 months since Thirst was restricted. Perhaps the more revealing statistic is the percentage of tournament victories Tezzeret has achieved in this time period.

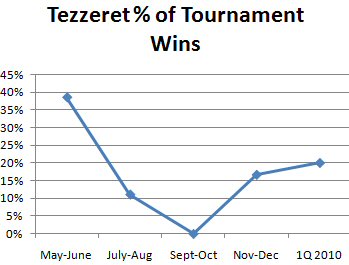

As you can see in this chart, graphing the percentage of tournament victories by time period, the biggest difference since the restriction of Thirst may not be Tezzeret’s Top 8 %, but rather the % of tournament victories. Post-restriction, Tezzeret saw a tremendous 75% dip in the proportion of tournaments it was winning, falling from almost 40% of tournaments to just above 10%. From July through October of 2009, Tezzeret won a miniscule number of tournaments. It seems to have repositioned itself and is doing better in recent months, but nowhere near its pre-restriction levels of dominance. In the first quarter, Tezzeret won 20% of tournaments, a post-restriction peak.

In the previous metagame report, I speculated that the restriction of Thirst had finally worked its way through the format, and Tezzeret had bottomed out as a result of several metagame factors, including the success of Bant Fish and Oath (which took advantage of the overreliance on the Dark Confidant draw engine). Consequently, I expected Tezzeret to recoup some of its losses. In Q1, Tezzeret surged ahead of the competition once again, outperforming even my expectations. Tezzeret posted the greatest proportion of Top 8 appearances, and was tied for second in tournament victories. Why?

Perhaps the answer can be found in one of the most interesting archetype trends in the Q1. Last year at this time Tezzeret was a fractured archetype with many variants. Hiromichi Itou’s Vintage Championship victory with Bob Tezzeret helped consolidate the archetype, and almost all successful Tezzeret tournament pilots followed suit. In this time period, the archetype has fragmented once more into three distinct strains.

Bob Tezzeret remains the most successful variant, making up about 58% of the Top 8 Tezzeret lists. Remora Tezzeret variants are making a comeback, and are about 21% of Tezzeret variants. Eric Dupuis’ Tezzeret list with 4 Mystic Remoras and 4 Repeal is one prominent example. Of course, there are hybrid lists with both Bob and Remora.

But the most interesting development is the third major variant, represented by Ricardo’s list, which I listed above. This is a new take on the archetype. It’s virtually mono-blue, featuring both Mana Drain and Spell Pierce, and multiple Tezzeret. It has many more basic lands, and is built to survive the mana base assault by both Fish and Workshop decks. It has more bounce and more countermagic instead of a secondary draw engine. It uses Tezzeret to shut down the game, much like the old mono blue lists would accelerate Morphling to finish the game.

Recommendation: Sell

The archetype is evolving to survive in the new metagame with innovations that emphasize mana stability and implements to combat Oath. This fact accounts for Tezzeret’s market success in Q1. However, other developments threaten to overwhelm this trend. First, Worldwake’s Lodestone Golem has turned MUD into a metagame wrecking ball. It will not be possible to keep every Sphere off of the table. The new Tezzeret variant, largely mono blue, may have the mana stability to stay in the game, but resolving and activating Tezzeret will be increasingly challenging. The alternative, Bob Tezzeret lists, may ironically be more successful in combating the new MUD lists, but will be increasingly vulnerable to the second major obstacle to Tezzeret success: The popularity of Oath. Rather than subside, Oath has become more popular and successful since Worldwake, with Terastodon and Jace. The archetype also may take advantage of the best Vintage card in Rise of the Eldrazi, See Beyond. Third, experienced control players like Rich Shay, who might otherwise play Tezzeret, are becoming Oath converts. As the most experienced and knowledgeable players switch to Oath, this will further reduce Tezzeret’s chances of making top 8.

All of these factors support my sell position. However, Tezzeret is a resilient archetype. There is a great deal of sunk investment and experience with the archetype, and players will devote energy into innovating to ensure that the archetype is competitive. I suspect that Tezzeret’s percentage of tournament victories will decline, but I don’t expect its overall percentage of tournament Top 8s to decline significantly. It could see a modest 10-20% loss of market share, but it’s still a solid investment. I expect it will hold above 15% of Top 8s in the 2Q of 2010.

Creatures (14)

Lands (18)

Spells (28)

Workshop Aggro is arguably the most successful archetype in Vintage at the end of Q1, 2010. It enjoyed a 50% increase in market share from 2009, rising from 8.33% of Top 8s to 12.5%, and was increasingly profitable late into the first quarter. Although it has fewer top 8 appearances than Tezzeret or Fish, it has more tournament victories than any other archetype. In the last market report, I advised you to buy stock in this archetype.

Workshop Aggro constitutes two particular sub-archetypes: MUD and Mono Red Workshop Aggro. Occasionally, other archetypes play the role. What defines this archetype is it uses Mishra’s Workshop to power out fat creatures and Sphere effects rather than rely on Smokestack to achieve total control of the game. Instead, these decks achieve a soft lock with Sphere of Resistance, Thorn of Amethyst, Chalice of the Void and Tangle Wire, and win the game before the opponent can break the lock. This archetype will play a Sphere every on turn one almost every game, and many turns thereafter, punishing opponents with light or fragile manabases. It is not uncommon to have to pay 4 mana for a 2 mana spell when facing MUD.

In the past, the main beatsticks were Juggernaut or Arcbound Ravager, supported by Triskelion and Karn, Silver Golem. Worldwake gave the archetype an all new, highly synergistic beater, Lodestone Golem. Golem destroys the opponent while locking them out of the game. Now, Turn One Mishra’s Workshop, Mox, Lodestone Golem locks the opponent down while dealing substantial damage. The MUD variant often runs Metalworker as an additional, explosive mana source. Both variants use Sword of Fire and Ice to win the game quickly and generate card advantage. The Red variants take advantage of cards like Solemn Simulacrum and Goblin Welder for additional card advantage.

In the last metagame report, I advised investors to buy stock in this archetype because Lodestone Golem about as hot in the Vintage market as the iPad. I predicted that “both MUD and Mono Red variants [would appear] in lots of top 8s in February and March.” Since Worldwake only became legal in February, the quarterly statistics understate MUD’s success. For example, just looking at March, MUD decks make up 33% of Top 8s, by far the most successful archetype in March. Tezzeret has never even had a quarterly performance that strong in its entire existence. Perhaps even more stunning, MUD won a shocking 66% of tournaments in March, four of the six reported Vintage tournaments. It also won the largest tournament of the year so far, an Italian tournament with nearly 200 players, guaranteeing an appearance in the annual Vintage Year in Review (the winning list is the Ronzo’s list that I listed above).

A few key innovations have kept MUD competitive with other archetypes. Sculpting Steel is a simple answer to Inkwell Leviathan, Sphinx of the Steel Wind, and Darksteel Colossus. Duplicant also helps on the latter two, and is strong against Iona. Eon Hub, High Market and Blasting Station have emerged as additional answers to Oath, each with its own advantages, while Mishra’s Factory wins the game.

Recommendation: Buy

While I don’t expect another 50% increase in market share in Q2, 2010, I expect further growth, perhaps in the 25-40% market share growth. I foresee two feedback loops. First, the success of MUD so far will encourage pilots to continue playing MUD and inspire additional players to try the archetype, generating additional Top 8 appearances. Second, I expect a rise in the development and use of anti-Workshop technology in the coming months to combat Lodestone decks. However, the countervailing feedback loop is weaker, in the short-term, than the reinforcing feedback loop. This is true for at least three related reasons. First, the MUD decks already have the initiative over the metagame. Whatever adjustments are made, the MUD decks will carry their momentum deep into the second quarter. Second, there will be a time lag as players begin to adjust their sideboards and mainboards to compete with MUD. Not every player will prepare for MUD. It will take time as players become fully aware of the threat and test, through trial and error, their sideboards to adjust. Third, many traditional anti-Workshop cards will not be particularly effective against this new threat. In the Trinisphere era cards like Rack and Ruin, which would be spectacular in today’s metagame, were easy to play once you achieved three mana. Lodestone Golem, Thorn of Amethyst, and Sphere of Resistance are today’s lock parts, and Rack and Ruin will often cost 5 mana or more. If the Workshop player leads with Golem and Thorn, even Hurkyl’s Recall costs 4 mana. If Null Rod is in the mix, it will be even more costly, since you’ll need 4 lands to cast it. Innovative solutions, not traditional ones, may be needed. It will take time for these to emerge. In the meantime, this will be a very profitable archetype.

Creatures (21)

- 3 Meddling Mage

- 2 Trygon Predator

- 2 Aven Mindcensor

- 3 Tarmogoyf

- 1 Vendilion Clique

- 1 Cold-Eyed Selkie

- 4 Noble Hierarch

- 4 Qasali Pridemage

- 1 Thada Adel, Acquisitor

Lands (15)

Spells (24)

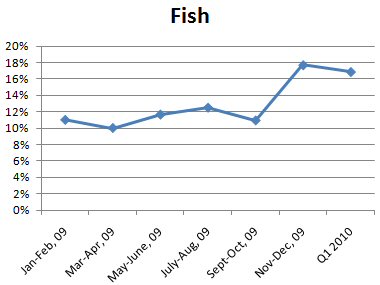

Fish continues to be a very profitable stock, and has the second most Top 8 appearances during the quarter. It is also tied with Tezzeret for the second most tournament victories during the quarter. Falling from a historic high of nearly 18% of the Top 8 market, it only lost about 5% of its market share in the first quarter, falling to 17% of Top 8s.

Fish is the format’s premiere blue-based aggro-control deck, and a focused Null Rod strategy. It pairs highly disruptive creatures like Meddling Mage, Qasali Pridemage, Trygon Predator, Thada Adel, and Aven Mindcensor with blue countermagic like Spell Pierce, Daze and Force of Will, built around the format defining Null Rod. Null Rod shuts down 40% of most mana bases (and Time Vault), while Wasteland bats cleanup. This allows Fish to compete on a level playing field. Then, cards like Qasali Pridemage take over, killing Golems, Oath, and Time Vault alike. Tarmogoyf is powered out with Noble Hierarch. Cold-Eyed Selkie and Thada Adel generate card advantage.

Three-quarters of the Fish decks are Bant Fish decks, or UGW. However, there are a number of Fish variants that have made Top 8. BUG Fish, once the most popular variant, still appears from time to time. Mono Blue variants are increasing in popularity, often taking their appearance from Legacy. Qasali Pridemage continues to be the driving factor behind much of Fish’s recent success. Spell Pierce has also given Fish a powerful new tool. Worldwake’s Nature’s Claim is now the most efficient answer to Oath and Workshops alike.

Fish stunned the market by outperforming every other stock in the final quarter of 2009. I predicted that Fish would return to its historic trendline of 10-12% of Top 8s, but I was mistaken. Fish has held its ground even in the post-Worldwake environment. Fish is just off its historic high of 18% of Top 8s, and has actually out performed itself in terms of tournament victories, with a record 20% of tournament victories in Q1, 2010. Despite being outperformed by Tezzeret in terms of Top 8 appearances, this is arguably Fish’s strongest quarter in contemporary Vintage.

Recommendation: Sell

This is a difficult recommendation for me to make. On the one hand, Fish’s success in March suggests that it can contend in a difficult market defined by Workshop Aggro and Oath, two traditionally terrible matchups for Oath. It apparently can do this on the back of Qasali Pridemage, Spell Pierce, Nature’s Claim, and to a lesser extent Thada Adel. On the other hand, the metagame is so naturally hostile to Fish that I have a difficult time seeing Fish can generate market growth and additional profits. I suspect that a good deal of Fish’s success is probably a feature of the surprising success that Tezzeret had in the first quarter. I expect Tezzeret to take a slight dip in the next quarter, and Fish to do so as well.

Creatures (3)

Planeswalkers (2)

Lands (14)

Spells (41)

- 1 Sensei's Divining Top

- 1 Brainstorm

- 3 Mana Drain

- 1 Forest

- 1 Vampiric Tutor

- 1 Mystical Tutor

- 4 Oath of Druids

- 1 Yawgmoth's Will

- 4 Force of Will

- 1 Sol Ring

- 1 Regrowth

- 1 Demonic Tutor

- 2 Island

- 1 Time Walk

- 1 Ancestral Recall

- 1 Mana Crypt

- 1 Time Vault

- 1 Gifts Ungiven

- 1 Merchant Scroll

- 1 Thirst for Knowledge

- 1 Tinker

- 1 Voltaic Key

- 1 Black Lotus

- 1 Mox Emerald

- 1 Mox Jet

- 1 Mox Pearl

- 1 Mox Ruby

- 1 Mox Sapphire

- 4 Spell Pierce

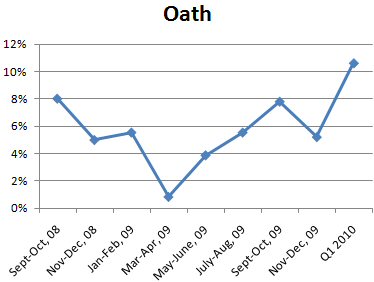

Oath experienced 50% market growth and tremendous profitability in the first quarter of 2010, rising to a historic high of 10.63% of Top 8s. Oath is currently the fourth most successful archetype in the market, in terms of Top 8 appearances.

Oath of Druids is built around the green enchantment to cheat extremely expensive creatures into play. If an opponent is unwilling to trigger Oath by playing a creature, then Forbidden Orchard will do it for them. Creatures like Iona, Terastodon, and Darksteel Colossus can win the game immediately or within a few short turns. The archetype supports this combo with plenty of countermagic, search, and draw. Iona has been a sharp improvement over previous win conditions, since she locks the opponent out of the game. These Oath lists also use Tezzeret to assemble the Time Vault combo as another route to victory.

Oath of Druids has been a traditionally cyclical archetype. It first appeared in modern Vintage with the printing of Forbidden Orchard in 2004. Since then, the archetype has seen surges with new printings, such as Hellkite Overlord and Iona, only to see the archetype fall back to earth. The chart above shows this trend. In the fall of 2008, Hellkite Overlord caused Oath to surge to 8% of Top 8s, only to slowly fall back to earth by mid-summer. Then, it hit 8% again with Zendikar and Iona, only to fall in November-December, 2009 back to around 5% of Top 8s. With Worldwake, Oath got new weapons of mass destruction in Terastodon, which has proven to be the optimal complement to Iona (although Emrakul is in the conversation). Also joining Terastodon is Jace, the Mind Sculptor, which helps the Oath pilot Brainstorm Oath targets back into the library. These two new weapons have sustained Oath and helped it reach record heights in the first quarter of 2010. For the first time since the Gush era, Oath has surged to more than 10% of Top 8s, and is the top deck choice of many of the format’s best pilots.

Recommendation: Buy

Since Oath is so cyclical, I would normally advise selling. In the last quarter, Vintage players adjusted to the Oath strategy with strong answers like Greater Gargadon and Sadistic Sacrament. The response was a precipitous decline to its historic baseline. Worldwake triggered another surge.

There are three reasons I recommend a ‘buy’ posture here. First, Rise of Eldrazi — if it contributes anything to Vintage — it helps Oath. See Beyond is solid in Oath, and Emrakul is a serious contender. Second, three sets of consecutive printings may have pushed Oath out of the ‘cycle’ it has experienced for the last five years into a permanent upper tier position. Iona, Jace, Spell Pierce, Terastodon, and now See Beyond have given Oath more tools than it’s ever had (arguably). What’s more, the typical answers, like Sadistic Sacrament, are not longer enough, as the Oath pilots now have 5 or more win conditions. And cards like Greater Gargadon or High Market can be Pithing Needled. Show and Tell out of the sideboard helps the Oath pilot evade these counter-tactics as well. Third, and perhaps most importantly, a large contingent of the format’s best players, from Rich Shay to LSV to Paul Mastriano favor the archetype. We may be seeing a slow exodus of top Tezzeret Control players to Oath, which, it just so happens, also has a Tezzeret and Time Vault in it. I expect to see growth in the Q2, or, at a minimum, no loss.

Creatures (23)

- 2 Ichorid

- 1 Flame-Kin Zealot

- 4 Golgari Grave-Troll

- 2 Golgari Thug

- 4 Stinkweed Imp

- 4 Narcomoeba

- 4 Bloodghast

- 1 Iona, Shield of Emeria

- 1 Terastodon

Lands (13)

Spells (24)

- 1 Ancestral Recall

- 4 Cabal Therapy

- 4 Serum Powder

- 4 Chalice of the Void

- 1 Darkblast

- 3 Dread Return

- 4 Bridge from Below

- 3 Nature's Claim

Sideboard

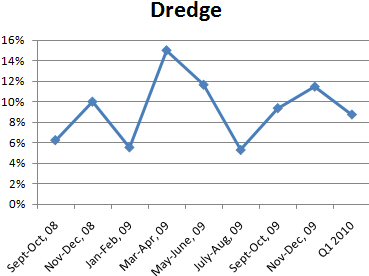

Dredge lost almost all of the market share gains it made the Nov-Dec. period, falling 23.65% to 8.75% of Top 8s, roughly its position in the Sept-Oct, period. Still, it’s a strong performer, the fifth best performing archetype in terms of top 8 appearances, and the third best performing archetype in terms of tournament victories.

Dredge is an archetype built around the Dredge mechanic. The deck has a simple game plan. The first step is to mulligan into Bazaar of Baghdad, aided by Serum Powder. The second step is to play Bazaar and discard cards with the Dredge ability. The third step is to dredge as much of your library into the graveyard as quickly as possible, using Bazaar on your second turn upkeep to dredge 10-12 cards, and your draw step to dredge 5-6 more. Fourth, by this point, you should have found some number of Narcomoeba, Bridge From Below or Bloodghast. Then, you can begin flashing back Cabal Therapy or and even play Dread Return. You want to generate as many tokens as possible, wiping out your opponents hand and Dread Returning Flame-Kin Zealot to win the game. Chalice of the Void and Unmask create a tempo advantage. The deck usually can goldfish by turn 3, and sometimes on turn two.

Dredge wins the vast majority of game 1s, but it has to interact post-board. Thus, the main challenge for the Dredge pilot is to answer opposing graveyard hate. This is why Dredge pilots love Nature’s Claim and use Chain of Vapor.

The striking thing about Dredge’s performance is that it’s winning tournaments. Dredge used to be a deck that would often make top 8, but almost never go the distance. That is no longer true. Dredge pilots are winning with increasing frequency, and the environment may be better than ever for them. Because of the crowded field, and need for mirror technology, decks find sideboard space increasingly valuable. MUD decks need answers to Oath, Fish, and the mirror, leaving little room for meaningful Dredge hate. Matt Sperling even recommended ignoring the Dredge matchup entirely. Other decks are finding it difficult to devote sufficient space to meaningfully address the Dredge matchup, and many players cheat on their anti-Dredge package. Even with powerful new tools like Bojuka Bog, Dredge seems better positioned than ever.

Recommendations: Buy

I think Dredge has room for additional growth in the next quarter. It’s not getting a lot of attention, but it’s quietly winning tournaments. The field is crowded and hot, and Dredge pilots are finding success while the biggies, MUD, Oath, Fish and Tezzeret fight it out amongst themselves. At worst, Dredge will stay where it is. It’s a solid buy.

Creatures (1)

Lands (10)

Spells (49)

- 1 Tendrils of Agony

- 1 Brainstorm

- 2 Cabal Ritual

- 1 Yawgmoth's Bargain

- 1 Vampiric Tutor

- 1 Mystical Tutor

- 1 Yawgmoth's Will

- 4 Duress

- 4 Force of Will

- 1 Necropotence

- 1 Mana Vault

- 1 Sol Ring

- 1 Demonic Tutor

- 1 Hurkyl's Recall

- 2 Island

- 1 Time Walk

- 4 Dark Ritual

- 1 Ancestral Recall

- 1 Imperial Seal

- 1 Grim Tutor

- 1 Mana Crypt

- 1 Timetwister

- 1 Gifts Ungiven

- 1 Mind's Desire

- 1 Merchant Scroll

- 1 Memory Jar

- 1 Chain of Vapor

- 1 Misdirection

- 1 Tinker

- 1 Black Lotus

- 1 Fact or Fiction

- 1 Lotus Petal

- 1 Mox Emerald

- 1 Mox Jet

- 1 Mox Pearl

- 1 Mox Ruby

- 1 Mox Sapphire

- 1 Ponder

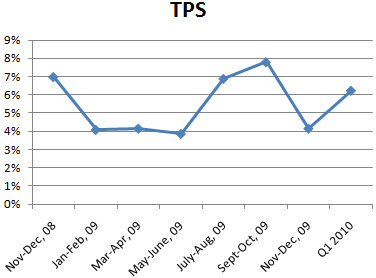

TPS enjoyed a nice boost in stock price in Q1, 2010, rising to 6.25% of Top 8s, a 50% increase over its Nov-Dec. performance. It’s the top performing Dark Ritual deck in the format.

TPS is a Dark Ritual based-storm deck that wins with power engines like Necropotence, Yawgmoth’s Bargain, Memory Jar, and Mind’s Desire (often in concert with each other or Yawgmoth’s Will) to generate card advantage to support a lethal Tendrils of Agony. The deck uses Duress and Force of Will to protect its spells, and a sturdy basic-heavy mana base to survive Wastelands. I’ve written a three part primer on TPS (The Perfect Storm, Playing The Perfect Storm, and Winning with TPS), if you are interested in learning more.

TPS won the Vintage Championship after the restriction of Gush and company. Then, the errata on Time Vault caused Tezzeret to usurp TPS’s position as the format’s top deck. TPS saw a brief surge following the restriction of Thirst, but that subsided, particularly with the printing of Mindbreak Trap. Last time, I recommended that you buy TPS, as I thought TPS has bottomed out.

Recommendation: Buy

TPS’s greatest historic success was in the time period just before Trinsphere was restricted. This is because TPS was the best performing deck against Trinisphere decks in that time period. TPS decks should once again model themselves on the TPS decks of 2004 to combat the new Workshop menace of Lodestone Golem. It also happens that the Oath metagame has created a metagame opening for TPS. While Iona is devastating, Darksteel Colossus and Terrastodon are whiffs, and Spell Pierce can be relatively safely played around. TPS’s worst matchup are Tezzeret decks, which have kept TPS in the margins. As Tezzeret Control subsides and morphs into an Oath-MUD-Fish metagame, TPS is a ripe metagame predator. Onward and upward.

Creatures (9)

Lands (18)

Spells (33)

- 1 Mana Vault

- 1 Sol Ring

- 3 Mountain

- 1 Mana Crypt

- 3 Sphere of Resistance

- 4 Crucible of Worlds

- 1 Trinisphere

- 1 Memory Jar

- 4 Smokestack

- 1 Black Lotus

- 4 Tangle Wire

- 1 Mox Emerald

- 1 Mox Jet

- 1 Mox Pearl

- 1 Mox Ruby

- 1 Mox Sapphire

- 4 Chalice of the Void

Sideboard

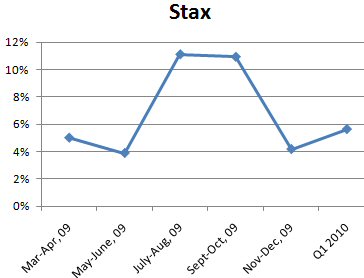

Stax saw modest gains in the first quarter of 2010, and is the only other deck that makes up more than 5% of Vintage Top 8s.

Stax is the more controlling Workshop archetype, with Crucible and Smokestack as central features. Stax eschews the Golem and uses the Welder + Bazaar synergy. Historically, it’s been a very successful Vintage archetype. But by almost any indicator, Stax is not doing terribly well. It’s making top 8, but it’s not winning tournaments — at all. It’s also falling in the bottom half of Top 8s, an even more telling statistic.

Recommendation: Sell

Stax has seen some measure of success in the last year, but the forecast is grim. Lodestone Golem will dominate Workshop decks in the foreseeable future. We may see Golem/Stax hybrid lists emerge, but Stax decks will likely go away for the time being. 5c Stax decks have disappeared entirely. Mono Red Stax lists can abuse Null Rod, but there isn’t any reason why Mono Red Workshop Aggro or MUD can’t use Null Rod even more effectively. This is a loser, and you should sell it while you can. There are no near-term prospects for success.

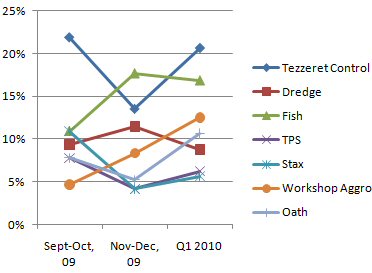

Because each of the graphs showing the trend line of a proportion of an archetype as percentage of Top 8s has been scaled, it’s difficult to clearly see how these archetypes are performing against each other. For that reason, I’m going to show three more graphs.

This graph shows the Top 7 performing archetypes as a % of Top 8s. As you can see, Tezzeret, Fish, and Workshop Aggro are currently the top 4 performing archetypes, by that measure. If you Stack the Workshop archetypes, then Workshops are performing at the top. But if you add Oath to Tezzeret, then it jumps above everything else once again.

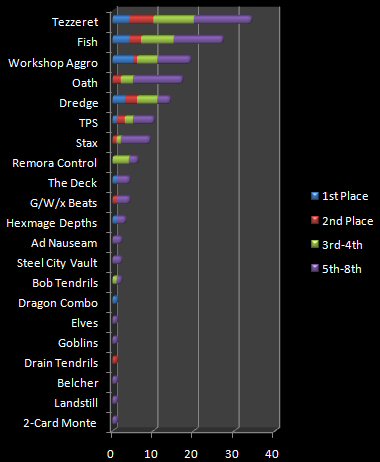

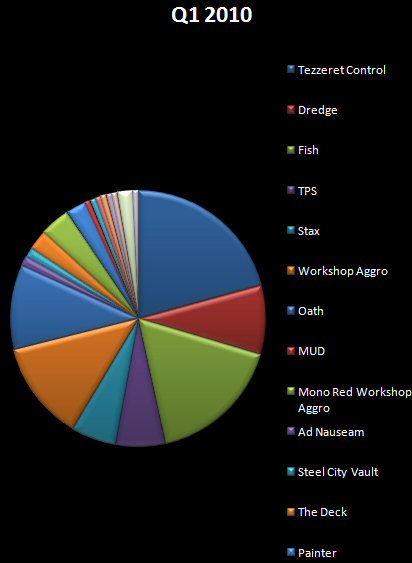

This graph shows the entire Vintage Top 8 market, featuring every deck that made a Top 8 in the first quarter of 2010. Here is that breakdown, with placement in top 8 in parenthesis:

The Q1, 2010 Metagame Breakdown by Archetype

34 Tezzeret Control (1,1,1,1,2,2,2,2,2,2,3,3,3,3,3,3,4,4,4,4,5,5,5,6,6,7,7,7,7,7,7,7,8,8)

27 Fish (1,1,1,1,2,2,2,3,3,3,3,4,4,4,4,5,6,6,6,6,6,7,8,8,8,8,8)

– 20 Bant

– 2 Mono Blue Merfolk

– 2 BUG Fish

– 1 Mono-Blue Fae

– 1 UW Fish

– 1 UB Fish

20 MUD/Mono Red-Workshop Aggro (1,1,1,1,1,2,3,4,4,4,4,5,5,5,6,6,6,8,8)

17 Oath (2,2,3,4,4,5,5,5,6,6,7,7,7,7,8,8,8)

14 Dredge (1,1,1,2,2,2,3,3,3,3,4,5,6,8)

10 TPS (1,2,2,4,4,5,6,7,7,8)

9 Stax (2,4,5,5,6,6,7,8,8)

6 Remora Control (3,3,4,4,5,5) (1 is hybrid Tez)

4 The Deck (1,7,8,8)

4 G/W/x Beats (2,5,6,7)

3 Mono Black Hexmage Depths (1,5,6)

2 Ad Nauseam (5,8)

2 Steel City Vault (6,6)

2 Bob Tendrils (3,5)

1 Dragon Combo (1)

1 Elves (6)

1 Goblins (5)

1 Drain Tendrils (2)

1 Belcher (7)

1 Landstill (7)

1 Two-Card Monte (8)

1 Unknown

Archetypes as a Percentage of Top 8s

Here is a pie chart that shows you the relative proportion of these archetypes in the top 8 field:

Because this report took so much time to produce, I will save the engine-level data for another time.

Until next time…

Appendix

1) Blue Bell, PA 1.2.10 (64 players)

1. Mono Black Hexmage Depths

2. Dredge

3. Tezzeret Control w/ NW

4. Bob Tezzeret Control

5. Oath

6. Oath

7. Oath

8. Bob Tezzeret Control

2) Alcobendas, Spain 1.10.10 (35 players)

1. Bant Fish

2. Mono Blue Faeries

3. Oath

4. TPS

5. Stax

6. Bant Fish

7. Stax

8. The Deck (4-5c Control)

3) Lindenhurst, Illinois 1.17.10 (39 players)

1. The Deck

2. TPS

3. Dredge

4. Oath

5. Ad Nauseam

6. Mono Black Hexmage Depths

7. Oath

8. Stax

4) Catalan Vintage League, Spain 1.23.10 (50 players)

1. Bant Fish

2. Bob Tezzeret Control

3. Tezzeret Control

4. Mono Blue Merfolk

5. Remora Tez

6. Mono Blue Merfolk

7. Bob Tez

8. Oath

5) Manila, Philippines 1.24.10 (42 players)

1. Dragon Combo

2. Oath

3. Bob Tezzeret Control

4. Dredge

5. G/W/x Beats

6. Bant Fish

7. G/W/x Beats

8. Culling the Weak Ad Nauseam

6) Breda, Netherlands 1.24.10 (49 players)

1. Bob Tezzeret Control

2. Bant Fish

3. BUG Fish

4. Stax

5. Bant Fish

6. TPS

7. Oath

8. Remora Tez

7) Selden, NY 1.23.10 (48 players)

1. Dredge

2. Bob Tezzeret Control

3. Dredge

4. Bant Fish

5. Stax

6. Elves

7. The Deck

8. Oath

8) Pawtucket, NY 1.23.10 (41 players)

1. Remora Tezzeret Control

2. Bob Tezzeret Control

3. Remora Tezzeret Control

4. Tezzeret Control

5. TPS

6. Stax

7. Oath

8. Oath

9) Catalan Vintage League, Spain 2.6.10 (51 players)

1. Tezzeret Control

2. Bob Tezzeret Control

3. Remora Control

4. Tezzeret Control

5. Remora Control

6. Bant Fish

7. TPS

8. Stax

10) Quebec, Canada 2.6.10 (73 players)

1. Bob Tezzeret Control

2. Oath

3. Tezzeret Control

4. BUG Fish

5. Goblins

6. Oath

7. Bob Tezzeret Control

8. The Deck

11) WL # 5, Italy 1.24.10 (39 players)

1. Dredge

2. Drain Tendrils

3. Bob Tezzeret Control

4. Oath

5. MUD/Stax

6. Steel City

7. Belcher

8. Bant Fish

12) Zurich, Switzerland 2.28.10 (42 players)

1. Dredge

2. G/W/x Beats

3. UW Fish

4. Bob Tezzeret Control

5. Remora Control / Tezzeret Control Hybrid

6. Steel City Vault

7. Bob Tezzeret Control

8. Bant Fish

13) Seldon, NY 2.20.10 33 players

1. MUD

2. Bob Tezzeret Control

3. Dredge

4. Mono Red Workshop Aggro

5. Dredge

6. Dredge

7. Landstill

8. Bant Fish

14) Philadelphia, PA 2.27.10 (82 players)

1. TPS

2. Dredge

3. Dredge

4. Bob Tezzeret Control

5. Oath

6. Remora Tezzeret Control

7. Bant Fish

8. Two-Card Monte (Workshop Combo)

15) Blue Bell, PA 3.13.10 (58 players)

1. Bant Fish

2. TPS/Jace Control Hybrid

3. Decklist Withheld

4. TPS

5. MUD

6. Stax

7. MUD

8. Bant Fish

16) Florence, Italy 3.14.10 (170 players)

1. MUD

2. Tezzeret Control

3. Bant Fish

4. Remora Control

5. MUD

6. G/W/x Beats

7. TPS

8. TPS

17) Catalan Vintage League, Spain# 6 3.13.10 ( 52 players)

1. MUD

2. Dredge

3. Remora Control

4. Remora Control

5. Oath

6. Remora/Bob Tezzeret Control

7. Tezzeret Control

8. UB Fish

18) Selden, NY 3.20.10 (39 players)

1. Bant Fish

2. Stax

3. MUD/Stax Hybrid

4. MUD/Stax Hybrid

5. Bant Fish

6. Bant Fish

7. Bob Tezzeret Control

8. Dredge

19) Breda, Netherlands 3.21.10 (42 players)

1. MUD

2. MUD

3. Bant Fish

4. MUD

5. Bob Tendrils

6. Mono Red Workshop Aggro

7. Bob Tezzeret Control

8. Mono Red Workshop Aggro

20) Zurich, Switzerland 3.28.10 (48 players)

1. MUD

2. Bant Fish

3. Bob Tendrils

4. MUD

5. Mono Black Hexmage Depths

6. MUD

7. Bob Tezzeret Control

8. MUD