Uh oh. Here we go again.

I’m sure many of you saw the phrase “Reserved List” in the title of this article and started sharpening your Internet pitchforks. Don’t worry — I’m not going to re-hash any of the usual Reserved List debates today. We’re not going to talk about whether the Reserved List is good or bad, what Wizards of the Coast (WotC) should do about it, whether or not WotC even has the legal standing to do anything about it, or any potential plans to circumvent the spirit of the Reserved List without technically violating its sacrosanct text. There is a place and a time for those discussions, and it’s on Jack Twitter’s Bad Bird Site.

All we need to do today is to try to answer three simple questions:

- Why have so many Reserved List cards lost value since mid-2018?

- Why have many of those same cards finally started spiking again this week?

- What’s going to happen next?

That’s it. Let’s get started.

Why Did Reserved List Prices Drop from 2018-2020?

Before we talk about why certain Reserved List cards are increasing in price now, let’s talk about why some Reserved List cards lost value over the past couple of years. As with most things in Magic finance, there is no single factor responsible for these price drops. As near as I can tell it was some combination of the following causes:

First, there are fewer high-profile Legacy events these days and Legacy has become more of a niche format. Several years ago, competitive grinders were more or less required to engage with a format that required owning Reserved List cards if they wanted to climb the ladder. These days, Legacy is almost entirely opt-in. The community is still wonderful and vibrant, but there are fewer opportunities to play and few reasons to engage other than a love for the format.

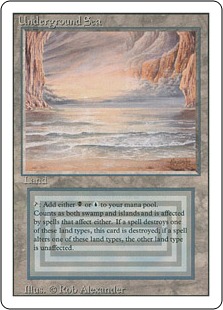

Second, some amount of Reserved List price erosion was probably inevitable. It’s incredibly rare for any card to sustain a post-spike price for long, especially when some of those spikes were 300-400% increases in value. The market for an Underground Sea at $700 is inevitably going to be smaller than the market for an Underground Sea at $300 due to the fact that fewer people have $700 to spend on a single card. Plus, when cards spike like that, the available supply tends to increase as players raid their old decks and binders in order to take advantage of the upgraded buylist prices.

Third, Reserved List prices started getting a bit frisky in late 2017, right about when Bitcoin went from a curiosity to a full-fledged phenomenon. There’s always been some crossover between the cryptocurrency trading market and high-end Magic collectors, so not only were those folks suddenly flush with cash, but expensive Magic cards were one of the easier things to buy with cryptocurrency. When Bitcoin really began to crater in late 2018, Reserved List buyouts more or less dried up.

Lastly, WotC hasn’t really given the player base a moment to breathe since 2018. From the release of Ultimate Masters to now, there has been a non-stop barrage of new sets, premium products, collectors’ items, and even a brand-new format to figure out. Not only that, but the Modern metagame experienced several major upheavals over the past few years, leaving seasoned players scrambling to build new decks around expensive new Modern Horizons cards. Reserved List cards tend to spike when there aren’t a whole bunch of other things to buy, and WotC has done their level best to make sure that the last two-and-a half years have been positively stuffed with things to buy-

It’s also important to note that the Reserved List (when taken as a whole) technically hasn’t actually lost any value since 2018. If you chart the price of every single card on the Reserved List and add them up over time, the 2018-2020 price chart will look relatively flat.

So why am I out here saying that Reserved List prices have been dropping over the past couple of years? Because most of the Reserved List cards that are widely owned (dual lands, Legacy staples) have been dropping while high-end Alpha and Beta cards have been making up the difference. This doesn’t have much of a bearing on today’s conversation, but I wanted to bring it up in case you read this article and then went to go look at some price charts and got confused about whether my entire premise was faulty. Even though the Reserved List as a whole has seemed relatively stable in recent years, it has seen significant value lost by any practical metric.

Why Reserved List Cards Are Spiking Now

A month ago, it looked like the entire Magic market might be entering a year-long slump. Both the Modern and Pioneer indexes were down 15% and showed no signs of rebounding. The Standard market was completely stagnant. Modern prices had already spent most of the winter slowly eroding, and it looked like the annual spring rebound was yet another casualty of COVID-19.

Things look very different today. The Modern market is up, and the Reserved List is having its first big resurgence in almost three years. Why is this happening? I’d wager it has to do with some combination of the following causes:

First, the U.S. Government sent out $1,200 stimulus checks to almost every adult in the country. I haven’t gotten mine yet since I’m a dirty freelancer who has to pay 1099 overages every year instead of getting a direct deposit refund, but most folks who have normal office jobs received their stimulus package several weeks ago. And while many Americans are currently out of work and reeling, plenty of Magic players have relatively safe and high-paying tech jobs. It isn’t surprising that some of these folks feel comfortable sinking their $1,200 into expensive Magic cards that they couldn’t otherwise justifying picking up, especially if they can find cards that are likely to keep rising in price.

Second, the Reserved List cards that are spiking right now are not the same Vintage and Legacy staples that drove the Reserved List market back in 2018. For example, City of Traitors is still readily available for $120 here on StarCityGames.com. Three years ago, it would have set you back at least $300. No, this time around, it’s Commander (and its unsanctioned competitive cousin cEDH) driving the price spikes.

Why Commander? Largely because it’s the most popular tabletop format in all of Magicdom right now. Anecdotally, I feel like Commander has been the biggest driver of Magic finance for the past several years, and this trend is likely to continue for the foreseeable future. As competitive Magic continues to embrace the age of Arena, WotC is taking advantage of Commander’s popularity in the tabletop space — as evidenced by 2020 being “The Year of Commander.” And the more people get invested, the more people start looking at those old Reserved List staples and licking their lips.

Also, Commander is the most stable Magic format right now. Modern has had a dizzying amount of turnover over the past few years, making it harder to justify dropping thousands of dollars on a deck than it was back when most decks had a two- to three-year viability window. Pioneer is still quite new. Standard is made to be turned over every few months. But if you buy a Wheel of Fortune for your Commander deck, you can be pretty certain that it’ll still be a top-tier card in the format for years and years to come.

Stability is especially key right now, when the world feels so unstable and uncertain. Not only has the world of Magic been shaken up in recent months by companions and Oko, Thief of Crowns and Modern Horizons, but the world outside of Magic is on very shaky ground. There’s a reason why gold tends to spike during periods of financial instability and market chaos — when the world feels completely out of whack, people fall back on the things that feel the most tangible. In the case of Magic, that’s Reserved List staples.

Lastly, there is some evidence that these spikes are being partially caused by a temporary lack of supply. Some of the bigger dealers were forced to close their warehouses for at least a couple of weeks during the peak of the pandemic, which has caused a temporary shortage of some cards that are usually a lot easier to find. Many dealers have struggled to find and maintain inventory; not only are there no in-person events to buy cards at, but the liquid cash required for collection buying is going toward rent for storefronts that aren’t bringing in any money. There has also been a massive shortage of plastic toploaders due to pandemic-related hold-ups in Chinese shipping and production, which has kept some smaller dealers from being able to sell as many cards as they usually would.

It’s unclear how much of an effect this is having on the market right now, but it certainly makes buyouts a lot easier and it’s exactly the sort of hidden effect that can move markets.

Will the Spikes Continue?

I expect to see another few weeks of Reserved List Commander spikes at least. People are paying attention to this trend now, and attention generally begets more price movement. The stimulus checks are still rolling out, there are still going to be warehouse closures and toploader shortages, big dealers will still have some trouble buying collections, and Reserved List cards are still going to feel safer and more secure than most other Magic purchases throughout the rest of the pandemic. The factors that caused these spikes simply aren’t going away anytime soon.

Longer-term, I’m still a believer in selling into hype. The Magic market usually booms in the spring before fading in the summer, and while the pandemic might throw a wrench at all of 2020’s seasonal trends, I’d still rather sell into a booming market than be stuck holding the bag during a bust.

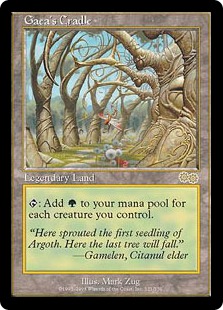

When it comes to Reserved List cards, there’s a temptation to assume that the cards won’t ever drop in value after a spike. It makes sense — WotC isn’t printing any more of these suckers, and it’s not like casual mages are going to be needing fewer Wheel of Fortunes or Gaea’s Cradles in the future, so why should the prices ever drop? People see these increases and assume they’ll never be able to own these cards and decide to shout about how frustrating the Reserved List is on social media. Honestly? I get it. The Reserved List can be super-frustrating. But if you’re patient enough, most of these cards will start to drop again once the eyes of the community move on to the next shiny object a few weeks from now. That’s what usually happens, anyway.

To that end, let’s talk about the Reserved List Commander and cEDH cards that have already spiked as well as the cards that might spike next.

It’s time to get actionable!

The Spikes So Far

I’m going to attempt to break these cards into categories based on how far along they are in their price spike cycle, but this data tends to be less reliable when we’re talking about older and more expensive cards like Reserved List staples. It’s easy to track movement for popular new cards like Teferi, Time Raveler, since hundreds of copies are bought and sold every week. When we’re looking at something like Gaea’s Cradle, I’m trying to discern trends based on five to ten overall sales that might be thrown completely out of whack by, for example, a single damaged copy selling for significantly less than market value.

That said, there are some clear trends in play here:

Over The Peak

These two cards peaked first, and they appear to have hit the limits of their growth curve already. Both staples roughly doubled in price early last week before losing about 20% of those gains, and those new price points look like they’re going to be pretty stable for the next couple of weeks at least. Feel free to sell your copies of these cards now, though Wheel of Fortune is the toast of Commander-town right now so I’m not sure it’ll drop all that much moving forward.

Still Rising

- Grim Monolith

- Survival of the Fittest

- Eureka

- Lion’s Eye Diamond

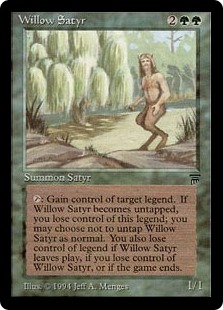

- Willow Satyr

- Gaea’s Cradle

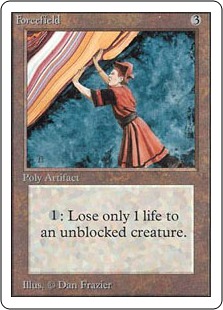

- Forcefield

- Gilded Drake

All eight of these cards are still trending up right now. It’s unclear when they will peak, though, and they all appear to be on slightly different journeys. For example, Gaea’s Cradle is slowly ticking upward one sale at a time, Willow Satyr was completely bought out, and Gilded Drake has peaked once, stabilized, and spiked again in a matter of days.

My guess is that most of these cards will peak over the next seven to ten days, so if you’re hoping to cash out your copies, pull them out of your collections now. Reserved List cards can take some time to sell, even when the market is rising, so you don’t want to end up trapped behind the curve.

What Might Spike Next

It’s hard to know what might spike next, because the spikes so far have been somewhat scattershot. A lot of them appear to have been triggered by cEDH demand, like Grim Monolith and Lion’s Eye Diamond, but cards that are only good in regular old multiplayer Commander don’t seem to be exempt from this rising tide either. I wouldn’t even be surprised if City of Traitors gets in on the action at some point, and nearly every Reserved List card worth its salt is worth considering right now.

I wanted to narrow the list down a bit, though, so here’s a list of the ten cards I’m focused on right now:

- Sliver Queen

- Metalworker

- Dream Halls

- Yawgmoth’s Will

- Aluren

- Palinchron

- Mox Diamond

- Intuition

- Shallow Grave

- Yavimaya Hollow

This is an odd list of cards, featuring both a $280 gem (Mox Diamond) and an $8 afterthought (Shallow Grave). But they all have one thing in common other than their places on the Reserved List: they’re good in Commander, or in cEDH, or in both.

Cards like Mox Diamond and Sliver Queen are unlikely to see a doubling in value like Wheel of Fortune, but they could see solid increases of 25-30% over the next few weeks and are worth picking up now if you’ve been holding out for a while. I also wouldn’t be shocked if Sliver Queen does eventually pull a Wheel of Fortune and end up in the $200+ range the next time WotC prints a Sliver-focused set.

Moving on, cards like Aluren and Palinchron are always in danger of seeing $20-$30 spikes. All it’ll take is a buyout, a highlight-reel performance in a popular Commander video, or the right Tweet at the right time. They’re both relatively low right now, and both are solid investment targets.

Dream Halls and Shallow Grave hit the spec buy sweet spot for me right now. They’ve both been much higher in the past, they both have unique effects, and the fact that they’re on the Reserved List makes buying in an incredibly low-risk proposition. Either card could — and probably will — double or triple in price at some point over the next year or so, regardless of what happens with these current spikes.

Lastly, Intuition is my sleeper pick for cEDH speculation. It’s a staple in that format, and if that really is what’s causing these spikes, it’s long overdue for an upward price adjustment. If I didn’t already have a few, I’d buy in ASAP.

This Week’s Trends

It was a weirdly quiet week for Standard finance, especially considering we’re currently in the second week of a brand-new metagame. The fact that most countries still haven’t had their tabletop release is likely playing a pretty big part in the ongoing market freeze.

As of now, it looks like Ikoria‘s heaviest hitters — Fiend Artisan; Luminous Broodmoth; Rielle, the Everwise; Lurrus of the Dream-Den; and the Triomes — are all still more or less stable at their pre-order prices. A few of the Apexes — Snapdax, Apex of the Hunt and Illuna, Apex of Wishes — have lost some value, but that’s about all the downward movement I’ve seen. Right now, it looks like there won’t be much movement at all until Ikoria starts hitting North American and European shelves. That is currently slated to happen on May 15th — still roughly two weeks away.

Meanwhile, the market has been hot for Commander and Modern staples. We’ve talked at length about Reserved List cards already, and a lot of the same reasons those cards spiked apply here. The Zendikar fetchlands are continuing to surge, joined once again by Wrenn and Six. That’s not much of a shock, but I was taken somewhat aback by a few other major spikes this week:

Why these specific cards? It’s all thanks to Commander and cEDH. Just like with the Reserved List cards, people are buying up expensive Commander staples like Craterhoof Behemoth and cEDH staples like Chrome Mox. And just like last week’s Modern gains, I expect these spikes to continue for at least another week or two due to the same supply chain worries and influx of stimulus money. If you’re in the short-term market for expensive Commander cards, snag whatever you need ASAP. If you’ve got any of these cards kicking around and you don’t need them, selling now is a solid call.

Pandemic or not, Magic: The Gathering is doing gangbusters business right now. Hasbro’s gaming revenue was up 40%(!) in Q1 of 2020, and Arena passed the two billion(!!) game mark. That’s massive growth any way you slice it. I’m sure some folks are already out there shouting about how this type of growth somehow means that tabletop Magic is doomed because Arena is likely the primary economic driver here, but all it tells me is that WotC’s strategy of paring Arena and tabletop is going really well for them. And with the writing process starting on the animated Netflix show and the potential for a live-action movie starring Angelina Jolie, it’s possible that 2021 and 2022 will be some pretty big years for Magic: The Gathering as a cultural force.

Speaking of WotC announcements, the next Secret Lair drop will be a set of basic lands featuring our old pal Godzilla. The Eldraine Wonderland Secret Lair featuring a set of Snow-Covered basic lands turned out to be one of the better buys from the initial set of drops, so it’s possible that the Godzilla basics will end up being a better-than-average purchase. I’m still probably not going to snag a set myself, though. I’m kind of burnt out on this series right now, and one of the things I liked about Eldraine Wonderland was that there really aren’t that many unique Snow-Covered lands out there for folks to choose from. There are plenty of unique basics already, so this cycle is unlikely to end up having quite as much demand. It’s not a bad deal at $29.99 if you want a set for yourself, and you should be able to re-sell your set at or close to that figure in the future, but if you’re looking for a good spec target, I’d look elsewhere.