I don’t know where the term ‘copycat’ comes from, because cats are nothing if not rugged individualists. Sometimes, I’ll copy what my cat does in order to

try and get a rise out of her, (How do YOU like getting YOUR nose nibbled, Coraline?) but she never mimics me in return.

The term ‘copyhuman’ would be much more accurate. Unlike our feline companions, people love to mimic each other. In psychology, the term ‘mirroring’ is

used to describe unconscious duplications that people make around others, especially around people that they either like or admire. Have you ever noticed

yourself slipping into the cadence of a close friend while deep in conversation? Do you smile more around a loved one with an infectious grin? That’s

mirroring – and people respond to it so well that it is sometimes used by scammers and conmen in order to initiate a bond of trust with their marks.

In many ways, copying others is the foundation of how we build our sense of self. We identify aspects of other people that we like and attempt to

incorporate them into our lives, internalizing what works and discarding what doesn’t. This self-made tapestry eventually becomes who we are.

It’s easy to avoid copying and incorporating obvious bad fits into our own lives. I hated taking French class in High School, so even though one of my

friends was thrilled to be accepted into a top linguistics program, I knew that path would be wrong for me.

It is much harder to reject ideologies and actions when they seem good at the outset. This happens often when something provides short term gains but long

term consequences (“These fries are so tasty! I’ll order them every day for lunch!”) or you continually see other people using that idea to get ahead but

can’t yet see the bigger picture. (“My friend the drug dealer always seems to have a ton of spare cash!”)

Those examples are loud and obvious, but the same line of thinking applies in subtle situations as well. For example, many players favor control decks

because “that’s what the pros like!” neglecting to consider that all deck choices are metagame-dependent, and understanding how to correctly pilot your

build is far more important than what you play.

In the world of Magic finance, people copy each other all the time. Whenever a run on a card causes supply to dry up within minutes, that is usually the

result of copycat speculators – people buying a card because “the price will go up!!” without thinking about the consequences.

When I talk about speculators, I tend to lump them all in together. In truth, people speculate in very different ways, and if you copy another speculator

who has very different motives and means, you’re going to end up making bad decisions.

It’s easy to filter out the advice that’s obviously good for everyone.

It’s much harder to ignore advice that’s good for some people…just not you.

I’m going to talk about speculation today, but not in a one-size-fits-all sort of way. I’ll be talking to each group of speculators individually, covering

what you should be doing in order to make money – and highlighting some bad advice you may have accidentally copied to your detriment. These

categorizations lack a psychological component, so they aren’t speculator psychographics. (Though I recommend checking out my article on trader psychographics if you haven’t read it.)

Each kind of speculator does have easily defined characteristics though, starting with –

The Day Trader

This is what most people picture when they think of a speculator. Day traders take advantage of small trends in the market in order to make a profit,

either by selling online or making lots of trades on the floor at big events. They are defined by their ability to make lots of transactions in a short

period of time.

Are you out there trading cards every single weekend, sometimes multiple times? Do you ever show up at a tournament just to trade? Do you spend your

evenings packing up cards and printing out mailing labels to fill orders? Do you watch the Pro Tour feed just to see what undiscovered goodies are being

run by the top players? Congratulations – you’re a day trader.

The Best Things You Can Do As A Day Trader

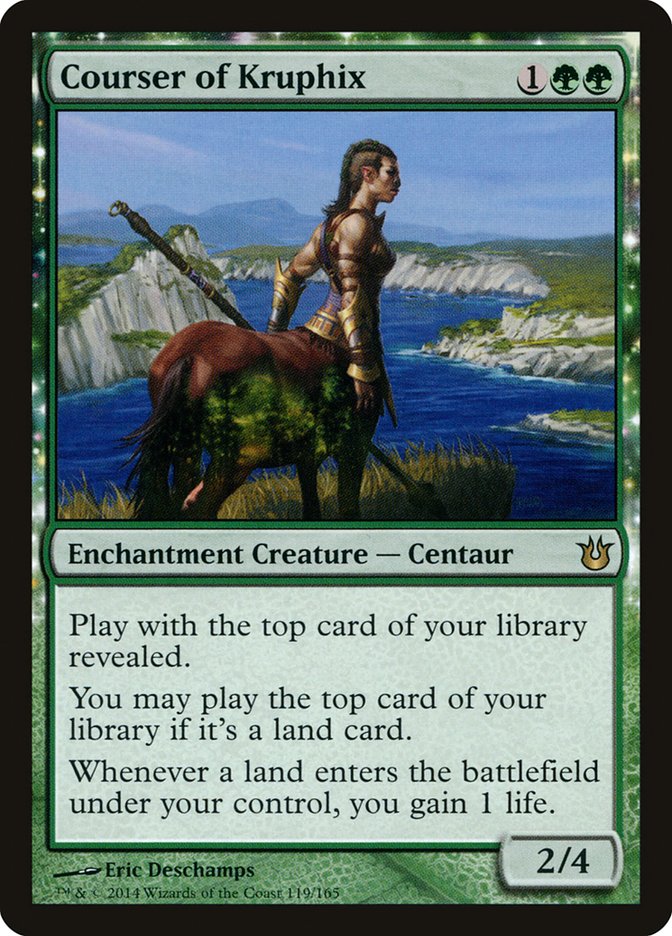

· Trade into high velocity staples, even if it comes at a small loss. By ‘high velocity,’ I’m talking about the ten or fifteen most popular cards in the

most popular competitive formats. Thoughtseize, Courser of Kruphix, etc. It does not matter if these cards will go down in price eventually, because

they’ll be long gone from your binder by then.

· Buy into hype if you’re fast enough. Amulet of Vigor may have been a busted spec from the Pro Tour earlier in the year, but only if you bought in at $5.

Those of us who got the tech quick enough were able to snag copies at $2 and flip them for $5-$6 right away. This is bread and butter for a good day

trader, and avoiding these quick-flips entirely because ‘spikes are bad’ is a mistake.

· Use buylists extensively. With no retail outlet, you’re always better off trading $6 worth of cards that buylist for $2 for a $5 card that buylists for

$3. This real, in-the-moment cash value matters much more to you than the theoretical price a card is selling for online.

The Biggest Mistakes Day Traders Make

· Don’t tie up too much of your capital in long term specs. 200 copies of Diluvian Primordial sitting in your closet do you no good. Even safe investments

like sealed product are not going to be worth your time. You want quick, actionable flips that allow you to leverage either a price spike or massive demand

on the trading floor.

· Don’t worry too much about trading away a card that you “know” is going to double in price a year from now. You’ll have a chance to buy back in before

the hype actually shows up. A BoP in the hand is worth two in the bush.

· Be aware of bigger trends, like set rotation and reprinting, but don’t let them scare you away from trading for cards that are going down in price. One

of your biggest advantages is the ability to get things done fast, which means that swiftly sinking cards can be more of an advantage to you than to people

who only get to FNM once every couple of weeks.

· It can be worth it for you to trade FOR hyped cards at the prerelease. Even if you know that the price will drop over the next couple of months, all you

need to do is find one motivated buyer who needs the latest and greatest staple for a tournament the following weekend, and you’ll be able to profit fairly

easily.

Even though they speculate in similar ways, Day Traders have very different abilities and goals than –

The Store Owner

Store owners are seen as the big dogs of the Magic speculation world, but this category includes everyone from the acquisitions team here at Star City

Games to that guy at your FNM who runs the singles counter. Do you have a way to regularly and successfully sell cards at full retail prices, either in

person or online? You’re a store owner.

Most store owners don’t need my advice. They’ve been in the game as long or longer than I have, and they’ve figured out what works for them and what

doesn’t. Successful store owners are able to adjust with the market, understand the power of liquidity, and are always willing to adapt their strategy as

new information becomes available. I have never been a store owner myself, but this is the advice that I’ve been able to gather from the most successful

owners I’ve spoken with:

The Best Things You Can Do As A Store Owner

· Learn what your customers want. Investment capital is limited, so don’t waste it on cards that won’t sell. If no one in your store plays Legacy, don’t

buy Legacy cards. If most of the people who buy from you are Commander players, be more aggressive acquiring casual staples. Having money tied up in cards

no one wants can be the difference between expanding your business or just treading water.

· Stock up on the smalls. As a store owner, it’s important to stock up on as many playable cards as you can within a popular format, not just the staples.

You want to be a one stop shop for deck building, and many of the smaller cards have the biggest margins. For a day trader, having 60 copies of Dark Ritual

just means a lengthy and annoying buylist process and a huge value hit. For you, it means getting $1 per card all day long.

· Create your own buylist. One of the biggest rookie mistakes people make when they first start a store or set up a case is using a different store or

website’s buylist when purchasing cards. Not only do different stores have different needs – see my above point – but prices can change on a dime. If

you’re relying on someone else to put your buy prices together, how can you expect to understand when you should raise a price and be aggressive or when

you should drop a price and back away? I’ve seen fledgling stores buried under tons of rotating staples because they used someone else’s buylist and didn’t

adjust quickly enough.

The Biggest Mistakes Store Owners Make

· A lack of flexibility. Much like with the day trader, you aren’t trying to hoard staples until the market eventually reaches what you think a card is

worth. Be aggressive, foster relationships, and give people a reason to need those expensive cards in the case. If you have an overpriced Legacy foil

collecting dust in your store where no one even plays Legacy, you’re tying up your money, your time and your real estate.

· Unlike the day trader, long term trends and set rotation matter a whole lot to you. Day traders have a smaller amount of stock and can travel more

looking for buyers than you can. If Standard dries up in the summer for you, being left with dozens of copies of each rotating staple bought for top dollar

in the spring can be catastrophic. Know your limits and stick to them.

· Stay away from inflationary cards and buyouts. You have a business to run, so don’t waste your time with the flavor of the week. Only pursue spiking

cards if it’s something that you know you’ll be able to sell easily and quickly at the new price.

· Be more aggressive when it comes to sure things. As a store owner, you should have an easier time finding collections for sale and more capital with

which to buy the big ones. If a collection is full of nice older staples, it’s generally worth going the extra mile to make the deal happen.

Store owners and day traders may drive the speculation market, but there are comparatively few of them. I’d love to do a demographic survey of my

readership, but I’d be surprised if more than 10% of you fall into one of the above categories. The rest of you? You’re –

The Long Haul Player

This category encapsulates everyone for whom Magic finance is more of a hobby than a way of life. On a good streak, you go to a tournament every couple of

weeks. You bring your binder to FNM and make a couple of deals if everything goes well. You actively buy and sell cards online, but there are times when

you get caught up in other things and your collection lies dormant for a little while. It doesn’t matter if you play every competitive format or you just

dabble in Commander, and it doesn’t matter if you’re speculating to make some extra dough or simply as a way to eventually work your way up to a tier one

Modern deck. If you aren’t doing this as a professional, you’re a long haul player.

The Best Things You Can Do As A Long Haul Player

· Figure out your long-term goals. Are you just trying to make money, or are you trying to establish a foothold in a format? If it’s the latter, make sure

all of your trades are made with that in mind. If you’re a casual player, picking up sets of future Commander staples in bulk is always a smart move. If

you’re getting into Legacy, start working your way toward duals one at a time. Without a concrete goal, you might find yourself making trades just for the

sake of it, which can lead to major regrets.

· Value long term stability over short term possibility. It’s better to drop $80 on a sealed box that you know will be at least $120 and could get into the

$200-$300 range over the next few years than to drop $5 on a card that might hit $8 but might drop to $3. Chances are, you won’t have the time to track the

price of the single closely enough to hit the right selling window even if it does spike briefly. You want to focus on things that can be sold for a profit

at any point.

· Don’t be afraid to play in long term ‘penny stocks.’ Here’s where picking up 200 copies of Diluvian Primordial at bulk rare prices or several dozen foil

copies of a current Legacy playable foil common makes sense. Just be aware that you’ll have to wait awhile and you’ll have to buylist your cards on the

other side, so don’t expect a wild return.

· Don’t be afraid to take in cards that you believe in across all formats. Store owners and day traders alike are always after staples that sell the

fastest, but you’d rather have cards that can sit in your binder awhile without too much risk of losing value. You can use this to your advantage on the

trading floor if you’ve got some easy-to-move cards available.

The Biggest Mistakes Long Haul Players Make

· Avoid trading away cards that you’ll need again in the future. If you play Modern, figure out which Return to Ravnica cards you’ll want going forward.

Don’t sell those during set rotation. This will save you a potentially large headache next spring.

· Stay away from price spikes altogether. You don’t have a way to move cards quickly (like a day trader) or at retail (like a store owner). More often than

not, you’ll be left with too many copies of a card that no one needs. This includes “good” specs as well as the obvious busts, unless you’re planning to

sell very quickly. If you had bought Thassa, Master of Waves, and Nykthos, Shrine to Nyx before PT: Theros last fall, you would have ended up with the

three hottest cards on the planet…for about a week, at which point they started to freefall back to their pre-PT values. If you’re going to speculate on

Standard cards at all, make sure you flip them as quickly as you can.

· Don’t follow the leader. The best speculation targets are cards that the Magic finance community is currently ignoring entirely – that’s part of why I’m

writing The Modern Series. As a day trader, you can make money buying into light hype and selling into heavy hype, but over the long haul you want to buy

into cards that have been stable for a while and have a chance of peaking down the road.

· Buylist only when necessary. You’re not in it for the quick flip, so you’ll only be buylisting the cards that sit in your binder for months on end

without so much as a nibble. Otherwise, hold out for a favorable trade whenever you can.

A store owner can make money buying dozens of collections at competitive rates, but doing that could bury a long haul player under a pile of hard-to-move

smalls. Day traders can ride waves of demand to fast profits, but store owners and long haul players will often be left holding the bag. Long haul players

can invest in casual cards and boxes that will rise in value over the long term, but that strategy would choke the revenue stream of a store or day trader.

The trick isn’t to figure out the best overall advice, but the advice that works best for you. Internalize that, and you’re well on your way to becoming

the best possible speculator version of yourself.

Conspiracy Set Review – Cards That Weren’t Out Last Week

There were only four non-reprint rares spoiled last week, but they’re still worth talking about. I’ll start there.

Custodi Soulbinders – $1.50

This is one of the better cards in this cycle, and it will likely be a fringe-playable card in token-based Commander decks. It isn’t among the top tier

token makers, though, so I suspect it’ll drop down into the bulk rare range before long.

Ignition Team – $1

This is going to be big a lot of the time, but it’s expensive, it’s conditional, and it doesn’t straight up win a multiplayer game. I’m never going to run

this over Insurrection or any of the cool dragons that also cost seven mana. Future bulk rare.

Grenzo’s Rebuttal – $1

I wish this gave you the ogre afterward because you could use this as a 2-for-1 when you had an empty board to clear out a bunch

of nonsense and end up with an ogre. As is, it still deals with a bunch of troublesome permanents at once, which is something red isn’t particularly great

at. This is probably a second or third tier Commander staple with a unique ability, so it should have some casual value going forward.

Canal Dredger – $0.50

This is useful in small cube formats where the overall card quality is very high. As a bit of a Catch-22 though, this card isn’t good enough to make the

cut in most of those formats.

Let’s move on to the reprints now, where things are a little spicier:

Stifle – $25 –

This is a fantastic Legacy reprint. Stifle is a useful staple from a small set that is now more than ten years old, so it’s nice to see a new generation of

players given access to it. My hope is that it’ll drop down even further, toward $20 or even $15, allowing more people to buy in at a discount. There’s a

good chance these won’t drop too much though, and demand for them should be pretty steady. If you think you’ll ever want a set for Legacy, approximately

one month from now will be a great time to buy in.

Mirari’s Wake – $15 –

I’m glad a new generation of casual players will get to see how broken this thing is. It’s a pet favorite of mine in Cube, and I suspect demand will remain

fairly high. This card hasn’t left the $10-$15 range for years, and I doubt it’ll happen now considering the reprint is at mythic.

Pernicious Deed – $15 –

This is another awesome reprint for a card that still shows up in Legacy on a fairly regular basis. I don’t think you’ll be seeing much of a price drop on

these established mythic reprints, so if you can pick these up in the $10-$12 range, you’re doing great.

Edric, Spymaster of Trest – $10 –

This card jumped from $5 to $15 when most of the cards from Commander 2011 jumped, and it started to see a little bit of Legacy play. Now that it’s getting

a reprint at rare, I fully expect the price to drop quite a bit. It’s only played in a couple of Legacy decks, and I wouldn’t be surprised if this ends up

around $5-$6 again.

Hydra Omnivore – $8 –

How many of you knew that the Commander version of this was up to $12!? At any rate, this is a nice reprint, though it’s a little disappointing that it has

been upped in rarity to mythic. These should drop down toward $4-$5 and are a nice long term buy there.

Vedalken Orrery – $6

– I pegged this as a possible reprint target when I did my Modern Series article on Fifth Dawn, but I didn’t expect it

would happen so soon! It’s a narrow casual card, so it should drop a little lower – probably to the $3-$4 range, at which point it’ll be an attractive long

term target.

Phage the Untouchable – $4

– The fact that this card is still just $4 despite last seeing print in freaking 10th Edition speaks to how underpowered it is next to modern

casual staples. There’s no upside here.

Deathrender – $4

– Perhaps the only Show and Tell variant that Travis Woo hasn’t tried to break, Deathrender has always been an underrated causal card that has flashed

competitive potential without ever getting there. The $6 price tag that had been on the Lorwyn version was mostly based on potential, not demand, so I can

see this card dropping in price even further now that it has been reprinted.

Ill-Gotten Gains – $2

– This card still sees play in Legacy from time to time as part of an ANT or TPS brew. This will be the first and only time it has seen print in foil.

Expect the premium version to start fairly high and increase in price over time.

Wolfbriar Elemental $1

– Future bulk rare.

This Week’s Trends

· First, everyone decided that the judge foil Force of Will was going to be worth $1k-$2k easily because it is so rare. Now, everyone has decided that it

will probably be shoved into random judge packets going forward and is a bad buy right now. My opinion is somewhere in the middle. WoTC has said that they

will make these available to judges in the future, but I doubt they will do much to dilute the rarity of them. They might be in conference packets, but I

doubt it. They made these to be incredibly special, and I think that whatever methods are required to get them in the future will also require judges to do

something special. You can find these in the ~$700-$800 range now (Star City is sold out at $800) and it’s possible that this is the bottom of the market.

Even though more will be released, never again will so many available copies hit the market at once. If you absolutely must have a set, I’d start looking

for copies now.

· There haven’t been any real changes in the Standard market from last week. The temples are still a great buy and keep rising. Very few people are paying

attention to the format right now, which is okay because it’s still mostly just the same decks from the past few months. It’s still fine to buy the cards

you think you’ll want in the fall and sell everything else.

· Modern season is here! And with it has come…no appreciable rise in the prices of Modern staples yet. As I’ve said before, I think the finance community

got ahead of themselves a little, and players bought in because they didn’t want to miss out. Hopefully, we can get through the whole season without prices

getting too crazy, but I doubt it. Snapcaster Mage and others have started to rebound slightly, and I’d expect the staples to start rising again very soon.