I often joke with my friends and family about how my day job is in television and my hobby is being a financial advisor. It’s funny how life works.

I started writing these columns because I liked trading. Before smartphones and up-to-the-second pricing updates and Magic finance columns, there was much more of an art to it. Trading was about having good sales skills—building a customer base and always trying to find the best fit for each situation. It’s still like that sometimes, but dollar values and hype matter far more than they used to. Everyone is a speculator now.

I came to trading very holistically. I’m a film major, not a business guy, so my education and passion lies in storytelling instead of numbers. As I have tried to break new ground for this column and learn the nitty-gritty of the finance world, I’ve taken to reading different investment blogs and articles—checking out the work of my counterparts on Wall Street. Most of these people are lifelong traders and members of the business community. They’re financial advisors for a living, not a hobby.

And you know what? Their advice is usually applicable to what we do as well. Whether you’re speculating on a hundred shares of Apple or a hundred copies of Burning Earth, the strategies and lessons are the same. Today I’m going to share an article with you that I found quite useful: Ten Investment Rules to Live By. The article was written by Lance Roberts, the CEO of Street Talk Live. I don’t much agree with the man’s right-of-center politics, but I’ve read a number of his financial advice columns and his work in that field seems sound to me. He’s especially good at delivering pragmatic advice to street level investors—guys and gals with small portfolios like you and me.

Here’s the twist: in addition to providing Roberts’ advice, I’ve included my own thoughts on how it applies to Magic finance. I found it useful, and I hope you do as well.

1) "You are a speculator, not an investor. Unlike Warren Buffet, who takes control of a company and can affect its financial direction, you can only speculate on the future price someone is willing to pay you for the pieces of paper you own today. Like any professional gambler, the secret to long-term success was best sung by Kenny Rogers: you gotta know when to hold ’em . . . know when to fold ‘em."

Roberts makes a great point here. We often speak of "investing" in Magic cards, but that’s the wrong word to use. You’re not using your capital to increase the innate value of the card; you’re simply buying up a bunch of copies and hoping that the price will go up.

There is an exception here, but it doesn’t apply to most of you. Certain name pros—known innovators—might be able to "invest" in a card and work towards giving it a higher price by winning events with it. If Brian Kibler believes that Archangel of Thune is currently massively underplayed in Standard, he can buy up a few hundred copies and then bring the deck to every event he plays in for the next few months. If he succeeds in making the card a mainstay in a tier 1 deck, he’ll probably make quite a bit of cash on his stockpiled singles. Of course, it’s hard for one person to change an entire metagame by themself. The card in question also needs to actually be both good and underrated.

The rest of us must resign ourselves to the fact that we are mere speculators. We have to hope that at some point in the future someone will decide that our pieces of paper with monsters and wizards on them are worth more than we paid for them today.

2) Asset allocation is the key to winning the long game. In today’s highly correlated world, there is little diversification between equity classes. Therefore, including other asset classes, like fixed income which provides a return of capital function with an income stream, can reduce portfolio volatility. Lower volatility portfolios outperforms over the long term by reducing the emotional mistakes caused by large portfolio swings.

Okay, there are a lot of big finance words in here that you may not have heard before. Let’s break them down one at a time so we can figure out what the heck Roberts is talking about.

Fixed Income Security – This is an investment (like a bond) where you give someone a bunch of money up front and they pay you a fixed amount of money every cycle that you’ve both agreed upon in advance—say $50/year for five years. When the security "matures," you get your initial payment back, and the cyclical payments stop.

Asset Allocation – The places where you put your money.

Equity Classes – Different kinds of stuff you put your money into. Bonds, cash, different types of stocks, real estate, etc.

What Roberts is saying here is that it matters a great deal which things you invest in. He prefers safer investments over riskier ones because if you lose half of your portfolio in one terrible swing you’re liable to make an emotional mistake ("sell sell sell!") that shoots you in the foot over the long run. He also points out that most people don’t diversify much between different kinds of equity—we’re an "all our eggs in one basket" kind of investment culture at the moment. He suggests putting some of your money into safer investments that pay out on a planned trajectory, like bonds.

In Magic, there aren’t many cards that mimic a fixed income security. In my mind, the best analog for these are sealed products. They aren’t sexy investments and they’ll rarely shoot up in price, but very few booster boxes are worth less now than they were when they were in print (and those were pretty easy to figure out because the sets were horrible from the get-go). The rest of them have all been slow and steady gainers.

The most volatile assets in Magic are Standard staples. If most of your Magical inventory is tied up in these cards, you may want to consider moving some of that value to a safer range of assets.

3) You can’t "buy low" if you don’t "sell high." Most investors do fairly well at "buying" but stink at "selling." The reason is purely emotional, driven primarily by "greed" and "fear." Like pruning and weeding a garden, a solid discipline of regularly taking profits, selling laggards, and rebalancing the allocation leads to a healthier portfolio over time.

This lesson applies directly to Magic and is probably the number one mistake that most new speculators make. I can’t tell you how many times I’ve seen people come in to FNM with thirty copies of a hot new card—think Gyre Sage right after the jump to $5—bragging about how much money they just made. Well, no. They actually spent money—$60 plus shipping on 30 copies of Gyre Sage at $2 each. If they sold the cards that night, there’s a good chance they made a nice little profit, but if they didn’t they might have been lucky to just get their money back.

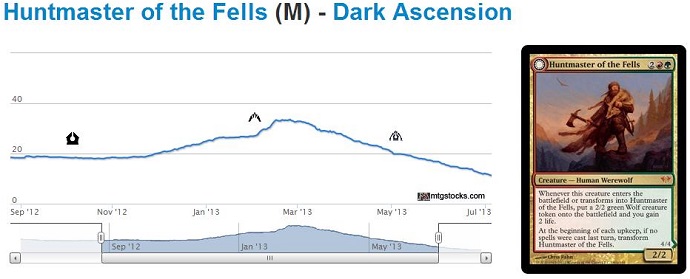

How do you know when to sell? One easy way is to check MTGStocks.com for the latest trend. Check out Huntmaster of the Fells:

It’s not hard to figure out where the peak was, and it’s very easy to see these trends happen in real time. When a card starts plateauing or trending down—even just a little—sell. It’s better to sell too soon than ride a lost cause all the way to the bottom of the market.

4) No investment discipline works all the time; however, sticking to discipline works always. Growth, value, international, small cap or bonds all have had times when they topped the charts in terms of return. However, like everything in life, investment styles cycle. There are times when growth outperforms value, or international is the place to be, but then it changes. The problem is that by the time investors realize what is working, they are late rotating into it. This is why the truly great investors stick to their discipline in good times and bad. Over the long term, sticking to what you know and understand will perform better than continually jumping from the "frying pan into the fire."

This applies more in the finance world than in Magic because different types of real-word investments require completely different areas of expertise. All Magic speculating is more or less the same: find an undervalued card, buy in, and hope the market corrects itself.

Even still, there’s some real value in sticking to what you know. The biggest mistakes I’ve made have been when I’ve taken the advice of someone on a format I was unfamiliar with. Here are a few bad decisions I’ve seen otherwise good speculators make because they strayed outside their strengths:

Jumping into a hyped or new format without understanding it – When Legacy and Modern when through their bubbles in 2010 and 2011, speculators went nuts for cards in formats that they didn’t have much experience in. This led to things like the $10 Plow Under—double digits for a card that saw approximately zero Modern play.

Assuming that casual cards behave like Standard cards – This is why you don’t trade for casual cards at the Prerelease even if you know it’s going to be a home run in Commander. The prices on these always trend downwards first.

Assuming that casual players like everything old, big, or weird – If you’re getting a trade throw-in, make sure it’s something you know will be desirable to someone. If you don’t trade casual cards much, avoid trading for cards that you think someone might want—the range of Commander cards that actually move well is very small.

Assuming that because a card is good in Standard it will be good in Modern / Legacy – This happens less now, but people still assume that just because a card is a Standard staple it’ll be an Eternal one too. Remember the days of the $50 Sword of War and Peace? What about $18 Hero of Bladehold? If you don’t follow Modern, don’t just assume that the top ten-to-twenty Standard cards in a given season will translate there.

5) Losing capital is destructive. Missing an opportunity is not. As any good poker player knows, once you run out of chips, you are out of the game. This is why knowing both "when" and "how much" to bet is critical to winning the game. The problem for most investors is that they are consistently betting "all in all of the time" as they are afraid of "missing out." The reality is that opportunities to invest in the market come along as often as taxicabs in New York City. However, trying to make up lost capital by not paying attention to the risk is a much more difficult thing to do.

This is my biggest weakness because I hate missing out on a great spec. Honestly, far too many of my investment decisions depend more on how much money I have to blow on Magic that week than good the spec is. When the M14 rules changes were announced, for example, I dropped a bunch of store credit on Thruns because it was burning a hole in my pocket. While it wasn’t a terrible spec, there were certainly better uses of that credit that came along in the next few weeks. For example, when M14 was released, I was a huge fan of Imposing Sovereign at $3. I was about to buy 30-40 of them, but I had the money earmarked for something else that week so I passed on the spec. The card has doubled since then. Ditto for Burning Earth, another card I was very high on.

When it doubt, save your money. Save it for the can’t-miss specs, the low-risk future staples, and the home-run hitters. Save it for buying lands in the summer and breakout cards during the first few rounds of Grand Prix and Pro Tours. Don’t just buy a few dozen whatevers just because you can—there will always be another card to buy. You might not always have more cash.

6) You most valuable and irreplaceable commodity is "time." Since the turn of the century, investors have recovered, theoretically, from two massive bear market corrections. After thirteen years, investors are now back to where they were in 2000 if we don’t adjust for inflation. The problem is that the one commodity that has been lost and can never be recovered is "time." For investors getting back to even is not an investment strategy. We are all "savers" that have a limited amount of time within which to save money for our retirement. If we were fifteen years from retirement in 2000, we are now staring it in the face with no more to show for it than what we had over a decade ago. Do not discount the value of "time" in your investment strategy.

This is certainly something worth taking to heart even if the lesson described here isn’t immediately applicable to Magic finance. So far Magic hasn’t ever had a major market correction, though if the player base ever drops significantly from its current highs we’ll get one for sure. Certain formats have had their prices collapse, but most of those downward trends were slow and predictable. I also hope that none of you are planning to retire off your Magic portfolios . . . right?

Even still, time is crucial in Magic finance as well. There is literally always money to be made, after all, as long as you’re willing to put in a roughly infinite amount of work.

Here are two things you can do that I guarantee you will make money:

1. Go through every buylist you can find. Look for prices that seem high. Cross-reference all those prices with sales prices on other sites. Look for arbitrage opportunities—just make sure you factor in shipping!

2. Go buy all the bulk Magic cards you can. Sort through them one by one and see if any of them appear on buylists for pennies apiece. Sell the ones you can as "singles" via the buylist and bulk everything else back out.

Both of those strategies will certainly make you some money, but it won’t be much. Most days it’ll be less than minimum wage. Do you really have enough time in your day to waste on that?

Time is a valuable resource. It can be used to better yourself, relax by yourself or socially, or even make a more lucrative investment. Every time you find yourself sorting bulk to try to squeeze every dime out of a collection or you agonize over speculating on a bulk rare that could go from $0.25 to $0.75, make sure you’re making the best use of your most limited resource.

7) Don’t mistake a "cyclical trend" as an "infinite direction." There is an old Wall Street axiom that says the "trend is your friend." Investors always tend to extrapolate the current trend into infinity. In 2007, the markets were expected to continue to grow as investors piled into the market top. In late 2008, individuals were convinced that the market was going to zero. Extremes are never the case. It is important to remember that the "trend is your friend" as long as you are paying attention to and respecting its direction. Get on the wrong side of the trend and it can become your worst enemy.

Many amateur Magic speculators are awful at this. When Voice of Resurgence hit $60, at least thirty people asked me directly if they should buy in. After all, you don’t want to miss the next Jace, right? No matter that it’s nearly impossible for any in-print card to sit at $60 for long, much less go any higher—people simply saw a line chart pointing up and didn’t want to be left behind.

Right now the Magic market is fairly weak with the exception of a few M14 cards like Scavenging Ooze and Lifebane Zombie. Everything else is floundering while these two cards keep selling out. Naturally, everyone keeps asking me if the time is right to buy Scavenging Oozes and Lifebane Zombies. Nope. It’s possible that these two cards will keep going up, but it’s more likely that the market will correct itself and these two will drop a bit while other undervalued cards rise in price. Aetherling and Advent of the Wurm are down to $4 retail and Varolz is at $2.50. But they’ll probably just keep dropping forever, right?

8) If you think you have it figured out, sell everything. Individuals go to college to become doctors, lawyers, and even circus clowns. Yet every day individuals pile into one of the most complicated games on the planet with their hard-earned savings with little or no education at all. For most individuals, when the markets are rising, their success breeds confidence. The longer the market rises, the more individuals attribute their success to their own skill. The reality is that a rising market covers up the multitude of investment mistakes that individuals make by taking on excessive risk, poor asset selection, or weak management skills. These errors are revealed by the forthcoming correction.

You can apply this to Magic in two different ways depending on how optimistic you feel.

The first is on a format-by-format basis. Everything in Legacy went up and up for years until they didn’t anymore. Everything in Modern went up, crashed, and then came back up again. Everything in Commander went up once and has started to slowly settle as individual cards lose value thanks to reprints. A lot of people had their collection appreciate five or tenfold over the past few years simply by owning cards that became more valuable as the player base grew. This isn’t good investing; it’s just having a lot of Magic cards. If a format keeps going up and up, don’t be afraid to sell and lock in your value while you can.

The other way to look at this is about Magic as a whole. Like I said, a lot of us made up a lot of value in the past few years simply by owning a ton of cards. Magic as a whole has never had a major market correction, and maybe it never will. Is that a chance you want to take? Granted, I’m probably never going to sell my casual collection, but it does make me think twice about my long-term investments. I think I have the two-to-five year market "figured out," but I could be totally wrong. Admitting that to yourself is hard but important.

9) Being a contrarian is tough, lonely, and generally right. Howard Marks once wrote that "Resisting—and thereby achieving success as a contrarian—isn’t easy. Things combine to make it difficult, including natural herd tendencies and the pain imposed by being out of step since momentum invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that ‘being too far ahead of your time is indistinguishable from being wrong.’) Given the uncertain nature of the future and thus the difficulty of being confident your position is the right one—especially as price moves against you—it’s challenging to be a lonely contrarian."

The best investments are generally made when going against the herd. Selling to the "greedy" and buying from the "fearful" are extremely difficult things to do without a very strong investment discipline, management protocol, and intestinal fortitude. For most investors, the reality is that they are inundated by "media chatter" which keeps them from making logical and intelligent investment decisions regarding their money, which unfortunately leads to bad outcomes.

That quote there has one of my favorite lines about investing—being too far ahead of your time is indistinguishable from being wrong. It immediately reminded me of the prediction I made about Kalonian Hydra being an $8-$10 card over the long term. Am I wrong, or am I right but ahead of my time? More importantly, does it actually matter? Does it make you money to suspect that at some point in the unknown future that card will be worth less than it is today? Does it cost you any?

I would argue that it does. If you have a good sense of what the market will do over the next six to twelve months, you can position yourself well over the long term as well as the short. As long as you don’t drop money into dead formats, banned cards, or other places where the chance of recovery is minimal, you almost always want to zig while everyone else is zagging. That’s why the release of Theros will be the best time to trade for rotating Innistrad staples—you’ll be trading hyped cards at the height of their demand for rotating "junk" that no one needs anymore.

It’s always good to see what has fallen out of demand and try to figure out why. Sometimes it’s just a small metagame lurch that will correct itself before long. This is where your best speculation opportunities are—the places where no one else is looking.

10) Benchmarking performance only benefits Wall Street. The best thing you can do for your portfolio is to quit benchmarking it against a random market index that has absolutely nothing to do with your goals, risk tolerance, or time horizon. Tom Dorsey summed this up well by stating that:

"Comparison in the financial arena is the main reason clients have trouble patiently sitting on their hands, letting whatever process they are comfortable with work for them. They get waylaid by some comparison along the way and lose their focus. If you tell a client that they made 12% on their account, they are very pleased. If you subsequently inform them that ‘everyone else’ made 14%, you have made them upset. The whole financial services industry as it is constructed now is predicated on making people upset so they will move their money around in a frenzy. Money in motion creates fees and commissions. The creation of more and more benchmarks and style boxes is nothing more than the creation of more things to COMPARE to, allowing clients to stay in a perpetual state of outrage."

The only benchmark that matters to you is the annual return that is specifically required to obtain your retirement goal in the future. If that rate is 4%, then trying to obtain 6% more than doubles the risk you have to take to achieve that return. The end result is that taking on more risk than is necessary will put your further away from your goal than you intended when something inevitably goes wrong.

This is good advice for life, not just investing.

How often do you come out of a Facebook session feeling better about yourself? Most of the time I end up comparing my life to everything on my newsfeed: the college buddy who has my dream job, the casual acquaintance who has the house I want, and a roughly infinite amount of people who seem to be constantly on vacation, partying every night, finishing books, and making the world a better place. Then I remember that star quarterback Robert Griffin III was born in the 90s, and I want to cry.

We spend too much time comparing ourselves to the best moments in everyone else’s lives. Those are the things that make it to Facebook, after all, not the hundreds of nights when you’re too tired to do anything after work except watch TV and collapse. We also love to compare our achievements against the world’s best and brightest. It’s true that I will never be as good at anything as Robert Griffin is at being a quarterback, but who cares? There are more than six billion of us—why do we constantly feel jealous over the several thousand folks on top? Those people are massive outliers. We are not. We also don’t know the true stories of most of these people or even the suffering that many of our friends do behind the scenes. Never wish you had someone else’s life without knowing their whole story. You might be surprised what they live with that you take for granted.

The same is true in finance. Don’t covet thy neighbor’s portfolio. Just because he hit on Falkenrath Aristocrat and made $500 on his spec doesn’t mean he didn’t swing and miss on nine other cards. And it certainly doesn’t mean that you should go out and blow $100 on the next random mythic because you want to prove to him that you’re just as good.

A certain number of people who make riskier investments than you will always make more money than you. A bunch more are going to lose massive chunks of capital while you slowly plug away with your gains. You’ll probably be jealous of the risky winners without considering all the losers, but that’s a mistake. Stay safe, be smart, and only swing that home run bat when you think you’ve got a good shot to connect. Leave the major losses to someone else.

This Week’s Trends

– From the Vault: Twenty cards have hit the StarCityGames.com website, but they’re all out of stock. The prices are quite a bit cheaper than I predicted in my article, and SCG will likely raise the prices before they actually stock the singles. If they don’t, I suggest picking up any of the cards from the set that you need when they are released—the prices won’t ever be cheaper. I put out a restock alert on a few that caught my eye.

– M14 cards are still staying fairly high across the board a month after release. This is pretty typical compared to M12 and M13—Chandra, the Firebrand saw no play when she first came out but stayed at $35 retail or above through the end of that August. These cards will probably start dropping hard once Theros spoilers begin. The in-demand cards may stay high all year thanks to slow sales.

– Former spec darling Beck // Call is down to $0.75 on SCG. This is a nice low-risk pickup over the long term in Modern.

– Horizon Canopy peaked close to $40 last week before settling back down in the mid $20s. It should probably be fairly stable at $20-$25 as long as it keeps seeing play. Feel free to sell if you’re sitting on any.

– Shadow of a Doubt is selling well in the $7-$10 range. This was my huge spec when Ravnica: City of Guilds came out, so it would be pretty awesome for me if I had any left. I don’t, though, because that was eight years ago.

– Shocklands have finally started to trend upwards. This is your last chance to buy in.

Until next time –

– Chas Andres