Bears are the coolest, most awesome animals on the planet.

One of my Commander decks—though I don’t play with it much because it is objectively terrible—is a tribal Bear deck that does what it can to win with an army of 2/2 grizzly fiends. I traded a Karakas to my friend Jeff a couple years back in exchange for his talents as an artist, and most of the cards in the deck that didn’t have Bears on them before have had them seamlessly added to the art. For example, here is a Bear coming out of the cannon in the card Doom Cannon:

My general, Rafiq of the Too Many Bears, has lots of Bear-related spells to back up his relentless onslaught. For example, Lay Bare is excellent at countering spells, and Hibernation is the ultimate way to escape a Day of Judgment. Also, Caller of the Claw is surprisingly good at replacing any lost Bears with brand new ones. Every spell in the deck is a winner.

Of course, the greatest Bear-related feat belongs to Thomas David Baker, whose Bear deck broke Vintage in half at worlds 2009. His abbreviated tournament report can be found here, and it is well worth the read.

While bears are great in both real life and in Magic, they’re kind of crappy in the world of economics. The term ‘bear market’ refers to a time when prices are falling and buyers have most of the power. This is in opposition to a bull market, which is when prices are going up and the advantage belongs to the seller.

What do falling markets have to do with bears? Glad you asked! No one knows for sure, but there are two leading theories as to how bears became inexorably linked to times of economic downturn.

The first theory states that fur traders in Canada (or possibly London, because those two places are roughly the same) realized that they could make a lot more money selling bearskins that they didn’t actually have when the market was up and then buying the furs later on when the market was down. This is similar to what investors now call ‘selling short.’

The second theory is that the metaphor came from very real fights that took place between bulls and bears in both England and California during Victorian times. Apparently someone back then decided that bulls and bears were mortal enemies, so they decided to let them settle their battle for animal supremacy in epic staged battles. The bulls would strike up with their horns, while the bears would strike down with their jaws. Thus, they (probably didn’t, because this story is rather insane) became the respective symbols for rising and falling markets.

Regardless of how bears weaseled their way into the world of finance, they’re here to stay. And while it’s not really important to know how the bear market got its name, it’s certainly important that you know what a bear market looks like and what to do when one occurs.

Before the Bear

Being able to identify an impending bear market is harder than it looks. Hindsight is 20/20, and anyone with a perfect track record would be able to make a killing every time. It’s a lot easier to look at the graphs a couple months later, nod your head, and say, "Yeah, probably should have seen that one coming."

The problem is exacerbated in the Magic world because we lack an index with which to keep track of the market.

On Wall Street, stock analysts use different indexes—groupings of different stocks—as a rule of thumb to tell how the market is performing as a whole. Even if you know nothing about stocks, you’ve heard of these; the Dow Jones measures daily growth in the industrial and manufacturing sector, while the NASDAQ Composite keeps track of technology companies. When people say, "The market is down," they’re usually referring to a drop in one of these indexes, which contain many of the biggest and most stable companies in their respective field. If the NASDAQ is down, chances are almost every tech company on the floor is trending in the same direction.

We could easily do the same with Magic—Standard, Legacy, Casual, and Modern indexes would be supremely useful—but to date, no one has taken on the problem. Without indexes, large trends in Magic often go unnoticed and bear markets often sneak up without much warning.

If you do sense a bear market approaching, here a few things you can do:

- Put all collection buying on hold (unless the deal is insane).

- Cash out your portfolio of Standard cards. These are your most volatile assets.

- Trade out of your single-deck Legacy and Modern cards. Their demand is linked to a single archetype, and they are also likely to take a hit.

- Only trade for cards that you think will survive the market’s tumble. Dual lands and Alpha/Beta cards tend to weather all storms.

If you can only make Standard-for-Standard trades where you play, try and aim for higher end staples that have proven your worth. The first cards to drop are things like Tibalt, the Fiend-Blooded and Molten-Tail Masticore: hype driven cards that held value mostly due to residual goodwill.

The Dog Bear Days

Many different factors can bring about a bear market, and they can happen pretty much any time. In Magic, though, there tends to be one time of year when things are always soft.

Despite cyclical interest in Legacy and Modern, Standard is still the format the drives most card sales. With large tournaments like the SCG Open Series occurring every weekend and ever-increasing support for Friday Night Magic, Standard no longer has a real ‘season’—these days, people play the format year-round.

Of course, this doesn’t mean that enthusiasm for the format is always equally strong.

Demand for Standard cards starts trending upward along with hype for the fall set, when the old block rotates out and a bevy of new strategies are unleashed. Interest in the format is generally high all winter, peaking in February (when the winter set is fresh) and May (when the spring set comes out).

Even though the format changes slightly with the summer release of the new core set, the hottest days of the year are generally the lowest point for interest in Standard. This is partially because the format has usually gotten pretty stale by this point and partially because few people want to invest in a rotating format. If a brand new tier 1 Standard deck was discovered tomorrow but required four copies of a $20 rare from New Phyrexia, most of the FNM crowd would probably shrug and wait it out until fall.

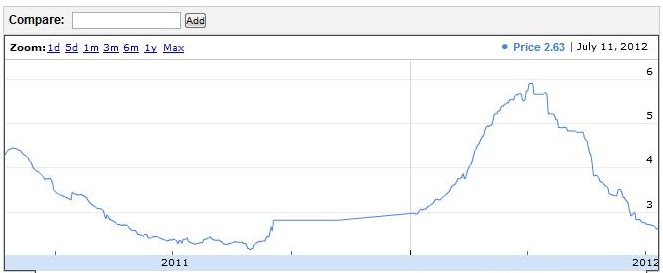

It’s hard to show these trends by analyzing one specific card, because there are a hundred other things that can cause a price to rise or fall. Just as a visual example, though, take a look at this chart for Black Sun’s Zenith:

You can see the card losing ground all spring with a small peak in late spring, staying low all summer, and cresting once more the following late winter/early spring before tapering off at rotation. While this one price alone isn’t evidence of this trend, anyone who’s been playing Magic for a couple of years knows what I’m getting at.

Standard isn’t the only reason that prices are low in the summer, though.

While Magic singles aren’t exactly popular Christmas gifts, most people are still in a buying mood during the holiday season; it probably has something to do with the frenzy of attention paid to consumerism and the increased amount of overall advertising. Because of this, prices for retail items across the board tend to be more expensive in November and December.

Further, Magic is very much an indoor game. Many of the people who play it still attend school, and it is more likely to be played in local shops and basements after classes in the winter than at camp or while in the woods during summer break.

There’s a lot competing for Magic’s time in July and August, especially when the heat is as brutal as it has been. When the thermometer is cresting 100 degrees every day and the power is on the fritz, buying a set of Primeval Titans isn’t exactly a priority.

This summer, then, seems to usually be an exceptionally bearish market. Remember Sorin, Lord of Innistrad? That planeswalker everyone gushed over back in February in that set that was short drafted and which will be Standard legal for another year? He’s down to $10 retail. While casual players are probably happy that they now have a good opportunity to pick up a set, I’m sure some of you who traded Legacy staples for your copies at $35 are kicking yourselves.

The bear market is here—that’s for sure. But what can you do about it?

Don’t Panic

The worst thing to do in a bear market is to panic and sell off all your assets. If you have a playset of Sorins that you’re in to at $125 or more, it doesn’t make sense to sell them at $40 unless you think they’re going to fall even more. Â

Magic cards are down across the board right now, and your collection is likely worth less now than it was three months ago. But unless you think this current trend is more than the usual summer malaise, prices will rise again in a couple of months.

Double Down

We all have cards that we believe are long-term winners.

For example, the double-faced foil Angel/Demon token from the Helvault retails at $49.99 here on SCG and generally sells on eBay between $38 and $45. There are fewer of these in the world than Black Lotuses, and many of them are in the permanent collections of casual players.

I don’t want to end the summer without a couple of these cards in my portfolio. They’ve come down a bit since the Helvault hype faded, and I don’t think they’ll come down any further—this is likely the bottom of the market. I also know that they’ll trade well, so I can get out at any point at a price very close to retail. If I had a bunch of long-term money to put into Magic right now, this would probably be my first target.

Another good place to invest right now is in Innistrad block rares.

Standard cards are almost always worth more during their second year of legality; see Black Sun’s Zenith above or any of the Scars of Mirrodin fastlands. Come autumn, we’ll all be drafting Return to Ravnica and the cards we still need from Innistrad, Avacyn Restored, and Dark Ascension will have disappeared from binders.

One of the best places to look for next year’s tech is in today’s Block Constructed lists.

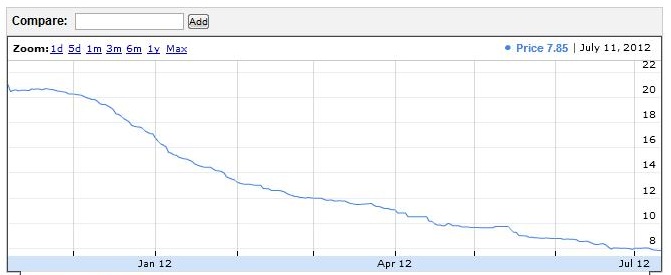

If you take a look at the winning decks from the Pro Tour in May, you’ll see a dozen interesting cards appearing over and over again: Wolfir Silverheart, Garruk Relentless, Bonfire of the Damned, and Huntmaster of the Fells, to name four. While Bonfire has done nothing but climb in price over recent months, take a look at this chart for Garruk Relentless:

You’re kidding me, right? The Pro Tour caused Wolfir Silverheart to explode in price, while a mythic rare—a planeswalker, no less—that was a three- and four-of in the top decks didn’t so much as tick up a dollar? I’d be shocked if Garruk Relentless isn’t $10-$15 by Christmas.

Leverage Inflated Assets

At the very end of a Standard season, there are usually just one or two very dominant decks. The cards in these decks have generally held their value, while everything else has tanked. Why? The people who are competitive enough to stick with Standard despite the impending rotation often want to play the best deck in the format, and the innovators have mostly moved on to other pursuits. While I have faith in the long-term value of staples like Restoration Angel, Bonfire of the Damned, and Geist of Saint Traft, it seems as though these are the only cards holding their value or rising in price right now. In my mind, these cards are inflated above the current summer low that most of the other Innistrad block staples are experiencing.

I’m not saying that you have to sell out of these few hot cards; Bonfire of the Damned is a solid $35 retail card right now and doesn’t seem to be slowing down. But if you can get someone to panic trade their fallen assets to you below their current value, it makes sense to make the deal. I bet you’ll find someone out there who will happily trade their four Sorins for your single Bonfire, and if you want to play W/B Tokens in the fall, you’ll be happy that you sold high and bought low.

Up Your Risk Factor

Most of my ‘what do to before a bear market’ paragraph can be boiled down to a single piece of advice: in the face of a downturn, dump your risky investments and stabilize your portfolio. When the market takes a tumble, you want to be the guy with the binder full of conservative investments—Wasteland and fetchlands that are as good as cash.

The opposite is true when you think the market is about to get a lot more bullish.

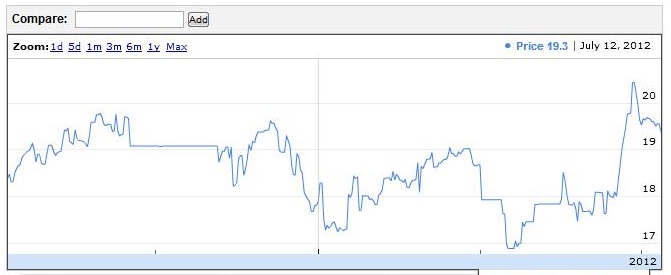

When prices are rising, those blue chips have very little room to grow. They might rise by 20% or 25% over a couple of months, but even that would be extreme. Here’s what would have happened to your Magic collection over the past year if you had it entirely tied up in Wooded Foothills:

And here’s the chart for Darkslick Shores over the same time frame:

Keep in mind when looking at both that there’s a chunk of data missing from August/September of 2011.

The point I’m trying to make is that, had you a pile of money and these two charts in early July 2011, you would have done well to buy as many copies of Darkslick Shores as possible. Then, once the price peaked in midwinter, you would have been smart to trade your risky investments (the Shores) for conservative ones (the Foothills). It’s a riff on ‘buy low, sell high’ with an extra dimension added for extra fun.

What cards seem like good risky buys right now? Besides the cards I mentioned above, I like Quirion Dryad as an extreme upside play and Mikaeus, the Unhallowed and Havengul Lich as casual risers. I also like Vorapede, Hellrider, and Lingering Souls—pretty much all of the decent cards in Dark Ascension, honestly. Keep an eye on Stromkirk Noble and Liliana of the Veil—did you know she was down to $15.99?—as well as the rare Innistrad lands in case Return to Ravnica is lighter on fixing than we all suspect.

Grizzly Man

Bear markets aren’t that scary once you get used to them. In fact, they tend to end with rising prices and a ton of people getting rich.

That said, you should always exercise the appropriate amount of caution. If you overextend into a bear market, you might find that what you thought was the bottom was actually just a plateau before the chart drops even deeper. While I don’t think that is the case for what seems like Magic’s annual summer dip, one can never be certain. The economy is still in dire straits, and consumer confidence is at a yearly low.

Making friends with the bear is okay—just don’t move to Alaska, move in, and expect him not to eat you.

Until next time —

— Chas Andres