“Chas, do you want my friend’s old baseball cards?” my mom asked. “He’s

moving and he doesn’t want them anymore.”

“How old?” I asked. Baseball cards from the fifties and sixties can be

worth big money, but collections from the late eighties and early nineties

are basically just very scratchy toilet paper.

“I don’t know, but they’re free. Do you want to take them or not?”

I did. Free is free, and I’m never one to turn down the opportunity to dig

for treasure.

The collection contained about 15,000 cards from 1978 through about 1985.

They weren’t new enough for me to simply discard them, but they weren’t old

enough for the collection to have been a goldmine. I ended up spending

several hours pulling cards from decaying binder pages, sorting through the

chaff, checking price guides, looking for rookies, and penny-sleeving

anything that looked promising.

And then I tried to sell the cards on eBay.

So far, it has been an absolute wasteland. Price guides have always been

something of a joke, of course, but cards that the book said were “worth”

$15 were only selling for $2-$3 shipped. I ended up lumping everything

together in a big flat rate box with teasing photos of the best cards, but

I haven’t had as much as a nibble.

In retrospect, looking through the cards simply wasn’t worth my time and

effort. My mom’s friend spent years of his childhood sorting, sleeving, and

lovingly compiling sets of his favorite teams, but here in the future I

would have been better off just donating the entire lot to Goodwill.

Remembering The Sports Card Bubble

In case you aren’t old enough to remember, sports cards were huge

back in the nineties. There’s a reason why old episodes of The Simpsons sometimes feature Comic Book Guy dealing in baseball

cards as well as his titular trade. Sports cards shops popped up all over

the place and became a ubiquitous sight on small town commercial strips.

There were baseball card trade shows, conventions, and a sense that the

hobby’s most collectable cards were a perfect target for long-term

investing. The stock market was doing strange things all the time, but they

weren’t making any more Cal Ripken Jr. rookie cards.

Speaking of Cal Ripken Jr, his 1982 rookie card went from a book value of

$12.50 in 1990 to $275 in 1993. While most gains weren’t that dramatic,

there was a clear upward trend throughout the late eighties and early

nineties. Ryne Sandberg jumped from $12 to $60, and Kirby Puckett tripled

from $120 to $375.

And, of course, everybody wanted that 1989 Upper Deck Ken Griffey Jr.

rookie card. It was the Tarmogoyf of its day, surging from $9 in 1990, to

$55 in 1993 to $75 in $1995. And even though the sports card bubble had

more or less popped by the year 2000, that Griffey was still popular enough

to hit $150 by the turn of the Willennium.

These days, you can pick up an ungraded copy between $25-$30.

So what the heck happened? Why did baseball cards tank so hard, and what

are the odds of the same thing happening to your Magic card collection?

Beyond that, what can the current state of the sports card market tell us

about the potential future of Magic finance? Which cards survived the burst

bubble, and why?

Read on, because some of these answers may surprise you. I know they

surprised me.

Bubble Bobble

The word “bubble” is thrown around every time a random Commander or

Reserved List card spikes in price, but let’s spend a moment talking about

what an economic bubble really is. While the term is used in many different

contexts, most bubbles follow the same basic pattern when they form:

-

There’s a spark of enthusiasm as a small group of people discover

either a new technology (blockchain) or legitimately scarce

commodity (Mickey Mantle rookie cards). - A whole bunch of new blood enters the marketplace.

-

All these new people create a ton of demand, driving up prices and

giving everybody confidence that there will never be a shortage of

interested buyers. It’s free money for days, baby! -

Because there are so many buyers, liquidity increases. This enables

dealers to vastly increase the volume of their purchases in order

to keep up with demand. Supply increases by leaps and bounds in

order to satiate all that new blood. -

Something bad (or a series of bad somethings) cause a crisis in

market confidence. Because supply and production have both

increased by such a vast amount, there simply aren’t enough buyers

to go around. Prices begin to free-fall, which in turn scares away

even more buyers.

The baseball card market is the perfect example of this. The bubble began

to grow in the eighties, and the first cards to spike were legitimately

scarce. Keep in mind that baseball cards weren’t really considered to be

“collectable” before this; they were just novelty items, meant to be

enjoyed by children and tossed aside when they grew up.

Because of the old fifties mentality, there aren’t all that many cards from

that decade left, and many of the ones that still exist are in poor shape.

Cards from the 1910s and 1920s, back when they only came as cigarette pack

throw-ins, are even rarer. Honus Wagner, the “holy grail” from this era,

was recently appraised for 3.12 million dollars.

Make no mistake, these early cards were legitimately undervalued. There

were way more people who wanted to own a Ted Williams rookie card than

there were Ted Williams rookie cards. There still are, in fact. Prices

didn’t skyrocket until the idea of “baseball card collector” became a

thing, but it’s important to understand that this wasn’t the

bubble. This was just the catalyst.

More on this a little later. For now, let’s move on to what happened next.

Everybody watched with awe as those cards from the fifties and sixties

spiked in price. This is about when the new blood entered the marketplace

and vowed not to miss out on “the next big thing.” Since it was the big

stars and rookies that everybody wanted from those older sets, everybody

went crazy for players like Cal Ripken Jr. and Ken Griffey Jr, two of the

biggest stars of the day. These value increases quickly became a

self-fulfilling prophecy, and the mania was on.

The number of cards produced exploded to match demand. While Topps was the

only mainstream sports card manufacturer for most of the fifties, sixties,

and seventies, it was joined in the late eighties by Fleer, Donruss, Upper

Deck, and more. Suddenly, there wasn’t just one rookie card for a specific

player but five or six, plus all sorts of foil variants. Even more

importantly, the production runs for the main sets increased by several

orders of magnitude as more and more card shop owners put in larger and

larger orders.

Lastly, the vast majority of these cards weren’t played with by children

and tossed away, they were carefully stashed in basements and closets, kept

in mint condition, as an “investment.” While the vast majority of cards

that were produced in the fifties no longer exist, the vast majority of

cards produced in the nineties still do.

So what caused the bubble to burst? It was inevitable, of course, but the

timing had a lot to do with the 1994 baseball strike that canceled the

second half of that season, including the World Series. Combine that with a

relatively minor economic downturn in the summer of 1994, and it was easy

to see why people began pulling back on their baseball card purchases.

Stores began to fold, prices dropped for the first time ever, and suddenly

everybody’s can’t-miss investments began to miss.

But What about Magic?

Let’s look at the rise and fall of the sports card market and see if we can

find any similarities to the current world of Magic finance. Let’s take a

look at some of the defining “bubble traits” of the sports card mania and

see if any of them apply to the current state of Magic finance.

- A legitimately scarce commodity is discovered.

This is somewhat true about Magic. The early Reserved List cards are

incredibly scarce, and it’s likely that the Power 9, dual lands, and rares

from Arabian Nights, Legends, and Antiquities have been

underpriced relative to demand for years.

That said, these cards have been slowly and steadily rising for a long

time.

I wrote a very similar article to this one back in 2012

, when people were asking “is Magic in a bubble?” as Underground Sea

climbed from $35 to $100 over a three year period. I’d argue that these

cards are legitimately scarce, but I’m not so sure about “discovered.”

- New blood enters the marketplace.

I don’t think that too many of the recent spikes have been due to new blood

entering the world of high end Magic collecting. My guess is that a lot of

these players and collectors have been around for years, albeit some of

them have recently come into more money lately either due to cryptocurrency

investing or simply aging into better jobs in a better economy.

If you’re trying to make sense of the Reserved List spikes, a narrative

that reads, “the sorts of players who have always wanted Black Lotuses and

dual lands have more money now” makes a lot more sense than “a whole bunch

of random folks who have never bought expensive Magic cards before are

suddenly fighting over the game’s most expensive staples.”

-

The market becomes way more liquid – there’s no shortage of

available buyers.

I can’t point to any numbers to prove my point on this one, but I haven’t

seen any evidence that the market is any more or less liquid than it’s

always been. The big buylists still run hot and cold based on available

stock, and if anything, most sites seem cautious to dip their toes into the

Reserved List price mania. You can find buyers for these cards, but it’s

nothing like the sort of mania that developed around sports cards or Beanie

Babies. Heck, it’s not even remotely approaching the cryptocurrency markets

of last fall and winter. I don’t get any “bubble” vibes here, either.

-

Dealers massively increase their stock. New dealers begin to

pop up everywhere.

Nope. Again, this seems like business as usual to me, albeit with slightly

higher prices on some older cards.

-

Manufacturers and distributors increase their supply.

In this instance, we’re pretty lucky that a single company has the

exclusive rights to Magic. Other companies produced their own CCGs back in

the nineties, but almost all of them are either gone now or owned by

Hasbro. There are other DCCGs now, of course, like Hearthstone and Eternal,

but Magic’s robust secondary market had nothing to do with the creation of

those other games.

So if Magic Finance Isn’t a Bubble…Will Prices Rise Forever?

Probably not. Just because Magic finance doesn’t appear to have any of the

signs of a classic bubble doesn’t mean that prices won’t peak and begin to

taper off at some point.

Remember how all those old sports cards from the mid-fifties began to spike

in the mid-eighties? There’s a reason why that happened, and it wasn’t just

because of scarcity. After all, there are plenty of scarce things that

don’t hold much value-newspaper clippings, say, or most older books.

The reason why those baseball cards spiked when they did was because of

nostalgia. Baseball fans who were eight years old in 1960 were thirty-three

years old in 1985 and just entering the height of their earning power. Not

only did they have the desire to buy back “a piece of their childhood,” but

they finally had the means.

I feel like a similar thing is happening now. If you were ten years old in

1995, looking wide-eyed at the Black Lotus in your LGS’ front case, you’re

thirty-three years old now. And yeah, millennial earning power is far lower

than the Boomer generation was at our age, but a lot of older Magic players

have fairly high-paying science and technology jobs. It’s not a leap to

think that plenty of the folks buying up all these older cards are

collectors who can afford it.

There is, of course, a limit to this. Will the folks who are interested in

playing Legacy and Vintage or even just collecting older cards at 33 still

be interested at 43? 53? 63? Will the younger generation of Magic players

still have the same connection to cards that are iconic to the older folks?

Only time will tell.

But What If You’re Wrong? What will Happen to my Expensive Cards?

The phrase “baseball cards were worth money back in the nineties, but they

really aren’t anymore” is a useful heuristic. At the very least, it will

prevent you from buying boxes of old Donruss sets at your local antique

mall or thrift shop, only to get home and discover that nobody will ever,

ever buy them from you.

Like most heuristics, however, there are loads of exceptions.

Back in 2012, a card collector named George Vrechek developed something

called the

Vrechek Vintage Card Index

. I’m not sure if it’s a regularly-updating thing or just something he did

for a single article, but it’s fairly illuminating. For example, here is

his index for the average price of several popular vintage Near Mint

complete sets from baseball’s golden era:

You can see the massive bubble building in the late eighties, and you can

see it begin to pop starting in 1992. It doesn’t pop fast, though, and

after bottoming out around 2001 you can see these cards begin to surge up,

up, up again.

Wait, but didn’t I start this article by talking about how the baseball

card collection I found was basically worthless? That’s because the VCI

doesn’t measure cards from the “boom” era of sports card collecting. It

only covers cards from that original, undervalued era. And, shockingly, it

appears as though you wouldn’t have lost money on those no matter when you

bought them – even at the height of the boom. Isn’t that bizarre?

I took a bit of a deeper dive into this stuff and discovered that the

following types of cards more or less survived the bubble unscathed:

The most valuable cards ever printed.

The Honus Wagners and Mickey Mantle rookies of the world are far more

expensive now than they were back at the height of the bubble.

Almost everything pre-1970.

If we’re comparing sports cards to Magic, I’d say that cards from 1960s and

earlier are roughly analogous to pre-Revised Magic while the

decade between 1970 and 1980 is sort of like the stretch from Fallen Empires to Urza’s Saga where the most powerful

cards are incredibly expensive, but the commons are still fairly common. If

the VCI is any indication, Magic’s oldest cards would survive any sort of

burst bubble – even if they had a couple of down years.

Graded cards.

One of the biggest differences between sports card collecting and Magic

collecting has to do with card grading. While some Magic cards are graded,

it’s a bit more of a curiosity. Serious sports card collectors are all

about graded cards, and these don’t seem to have missed a beat over the

years. A PSA 9 version of that old Griffey Rookie is still worth about $70,

while a PSA 10 is worth $350-$400.

There is also still a market for modern sports cards.

We think of sports card collecting as a bit of an old-timey hobby, but it’s

actually still going strong, albeit with a smaller user base. The market is

just small enough now that everybody who wants these mass-produced cards

from the eighties and early nineties already has more than enough of them.

There are still loads of sets being produced now, and people are still

willing to pay hundreds of dollars for top rookies, cards with bits of

game-worn jerseys, and gorgeous foils. You just don’t hear about any of

this because 95% of the folks who were “collecting” cards back during the

bubble have bowed out.

In Magic terms, this tells me that most of your older cards are safe,

especially those in terrific shape. We might have to have a talk if random

commons from Khans of Tarkir start to spike or something, but most

of the cards spiking right now are still akin to Topps baseball cards from

the fifties or at least significant rookie cards from the seventies.

What About The Fact that Magic is a Game and Not Just a Collectable?

This, of course, is what makes the entire analogy imperfect. It’s

impossible to say how much of Magic’s current value is driven by its

playability versus its collectors’ value. With baseball cards, a reprint of

a Ted Williams rookie card isn’t going to be a reasonable substitute for

anybody who is in the market for the real thing. In Magic, a reprint of,

say, Lion’s Eye Diamond is going to be acceptable for probably 90% of

everybody who wants that card.

The big question we’re left with at the end, then, is how much of the value

of an older Magic card is derived from its collectability versus its

playability in competitive formats.

The answer is fairly complicated. I’ve talked to competitive players who

believe that collectors make up a tiny sliver of the population, and that

Vintage and Legacy demand is the only reason why these cards are expensive.

I don’t think that they’re totally right, but I also must acknowledge that

The Tabernacle at Pendrell Vale would be worth way less than $3,000 if it

were banned in Legacy or reprinted tomorrow.

The blur between collectability and playability is blurry, too. Take

Thunder Spirit, a rare from Legends that currently retails for

about $250 despite the fact that it would likely be printed at uncommon if

it were eligible to be included in Core Set 2019. The card is

expensive because it’s good in Old School, a niche, casual-ish format that

does not allow modern reprints to be used. So are they collectors or

players? The answer, like usual, is a bit of both.

I don’t think it’s right to claim that major action by WotC-abolishing the

Reserved List, say-would prevent all these old cards from tanking because

everybody will still want the original printing of all these cards, but

it’s also incorrect to claim that Reserved List abolition would cause “the

bubble to pop.” As we’ve discussed, these cards aren’t in a bubble. They

were simply undervalued.

Again, this doesn’t mean that it’s 100% safe to buy these old, collectable

cards because they’ll never go down in price. It’s still possible that

demand is close to a peak right now, Magic as a whole may wane in

popularity, the older cards might not be as interesting to the next

generation of players (much like how you don’t care much about Ken Griffey

Jr. unless you saw him play), and WotC can always throw a wrench at

everything with some sort of crazy reprinting plan. The economy can

collapse. The world can end.

But I will say that I feel more confident about buying and keeping a bunch

of old and expensive Magic cards now than I did when I began writing this

article. That’s not nothing.

This Week’s Trends

-

One of the odd quirks of how people track card prices has led to a

couple of Welcome Deck exclusive Core Set 2019 cards to

experience what appear to have been significant value spikes. The Core Set 2019 version of Llanowar Elves, for example, was

briefly “worth” $80, while Aggressive Mammoth and Grasping

Scoundrel appeared to roughly quadruple in price.

So what are these cards actually worth? Well, the Core Set 2019

version of Llanowar Elves seems to be pretty stable in the $5 range now,

which is still pretty high for a common that’s supposed to be free. The

card sees a lot of play right now, though, and having a slightly rarer

version is pretty cool I guess.

Unless you really want these for a deck, though, I’d stay away. Yeah, they

might have some long-term value do to scarcity, but people are going to

forget all about them in a couple of months and the prices will come down

to nothing. In the meantime, let’s not encourage folks to raid their LGS’s

store of Welcome Decks, which are supposed to be free for new players

excited about joining our community.

-

Beyond that, Core Set 2019 hasn’t made much of an impact

on the Standard market.

As I talked about last week

, many players are simply sitting this format out until the fall. Core Set 2019 has even been flat or down on the MTGO

index, which is usually a bit livelier. I do expect some movement

over the next couple of weeks as the new metagame comes into focus,

though it won’t be nearly as extreme as it was back in May.

Mono-Green Aggro and Grixis Control cards seem like the best bet

right now, though the red-based aggro strategies aren’t going

anywhere, either.

Otherwise, Standard just keeps slowly dropping. It should bottom out in a

week or two, at which point it’ll be time to buy in for the fall.

-

Over in Modern,

Bant Spirits is the latest hot deck

. Zan Syed had a heck of a tournament with it in Worcester last

weekend, and several of its staples are spiking as a result.

Mausoleum Wanderer was the first to pop, jumping from $1 to $5 late

last week. Rattlechains, Selfless Spirit, and Spell Queller haven’t

moved yet, but that will probably change at some point soon-get

your copies now. Geist of Saint Traft might also see some action,

especially if it ends up being moved to the maindeck like some are

suggesting.

-

Much like Brightling a couple of weeks ago, another Battlebond card proved its meddle in Legacy last weekend:

Arcane Artisan. During my set review, I neglected to realize just

what a big game it was for Sneak and Show to get a creature version

of its titular spell. This forces your opponents to radically

re-think their sideboarding plans while also dodging Containment

Priest. This is no flash in the pan. The card is very good in that

deck, and it looks pretty stable at its new $20 price point. You

can sell your copies if you want, but there’s not rush.

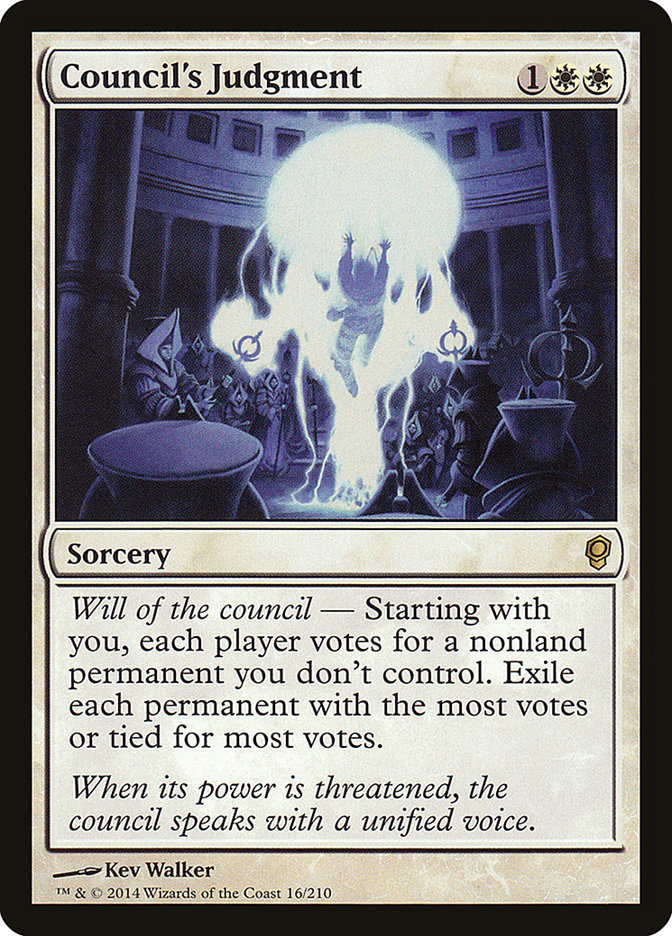

Council’s Judgment also went a bit crazy last week. It’s out of stock at

$20, and its current retail price is probably closer to $30. The card is

much better positioned in Legacy right now than it was before the bannings,

and I expect it to stabilize around $25 (until it’s reprinted, at least)

after spending years at or below $10. I’m selling into the $30 hype, but

holding is also fine.

-

Over in the land of casual Magic, Meishin, the Mind Cage jumped

from $2 to about $10 as people add them to their Arcades decks. It

also might be good in the upcoming enchantment-themed Commander

pre-con. Cards from old, weird sets like Saviors of Kamigawa don’t need to do much to maintain a

$10 price tag, but be aware that any reprint would bring this down

to bulk rare range. I’d sell these ASAP while Arcades is still the

hot new commander on the block.

-

Lastly, mark August 13th on your calendars. That’s when the SDCC

Comic-Con Planeswalkers will be available

on the Hasbro website

: $91.99, limit one per household. Yes, you should buy one. Even if

they don’t sell out instantly, they’ll eventually be worth more

than this.