There’s something rotten in the state of Magic finance.

Over the past couple of months, a number of single card bubbles have formed overnight, causing prices of certain cards to shoot from $2 to $20 or more. There is almost no way to predict where the bubble will strike next, and you can literally wake up one morning to the news that the internet has sold out of

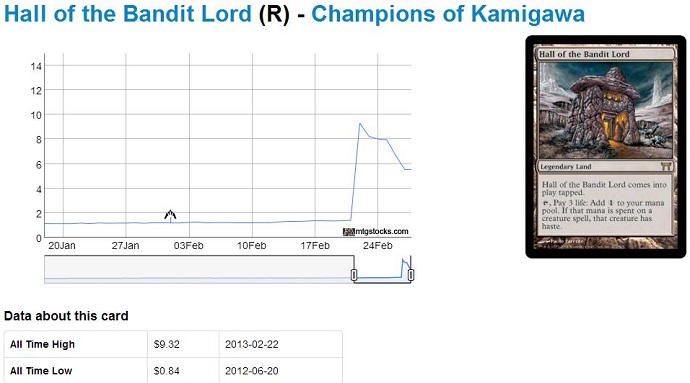

A prime example: Hall of the Bandit Lord.

Even more illuminating, check this out:

For weeks, nay, years, this card durdled between $0.50 and $2. It was a moderately popular casual rare that saw play in Commander decks where the upside of haste outshone the land’s major drawbacks. Earlier this month, it did see play as a two-of in a Legacy deck, but things like that happen all the time. Like all Eternal decks, the acquisition bottleneck is in other expensive cards, not that one random rare that’s relatively easy to find. Esper Stoneblade took down the SCG Legacy Open on February 17th, but that didn’t cause the price of Lingering Souls, Supreme Verdict, or even Batterskull to go up. Finding three copies of Jace, the Mind Sculptor and all those Tundras is what keeps more people from building that deck, after all.

So what is happening with Hall of the Bandit Lord and all these other crazy bubbles?

Over the past few weeks, a dozen people have asked me this question. They’ve asked me if I am active in a ring of speculators working to manipulate the market—I am not. They’ve asked me if I have knowledge of such a ring—I do not. They’ve asked me if I suspect any specific online or brick and mortar store of buying out the market in order to artificially inflate demand—I highly doubt it. Most of the articles I’ve seen about this issue make oblique reference to a shadowy cabal of Magic day traders, but if such a group exists, their presence is not known to me. Of course, considering my very public opinion about these kinds of actions, I doubt they’d invite me to the party.

At any rate, the closest thing I found to evidence of collusion was a post on the Quiet Speculation forums from a user named Mike C. who was trying to rally other active speculators around hyping a card for no reason so that they could all profit. His recruitment efforts went unrealized, at least in public, and many of the site’s active writers and contributors explained to him how harmful this could be to the community at large. While this isn’t evidence of anything, really—it’s easy to say one thing while actually doing the opposite—there certainly isn’t a visible effort to manipulate prices.

Personally, think there are several different factors coming into play here depending on the card. Let’s take a look at some of the recent single card bubbles and see if we can figure out what’s going on behind the scenes.

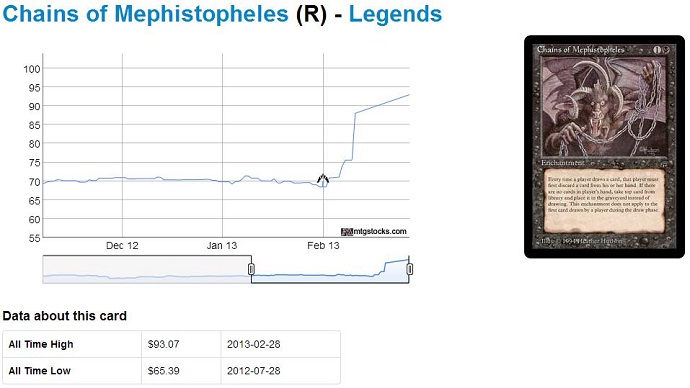

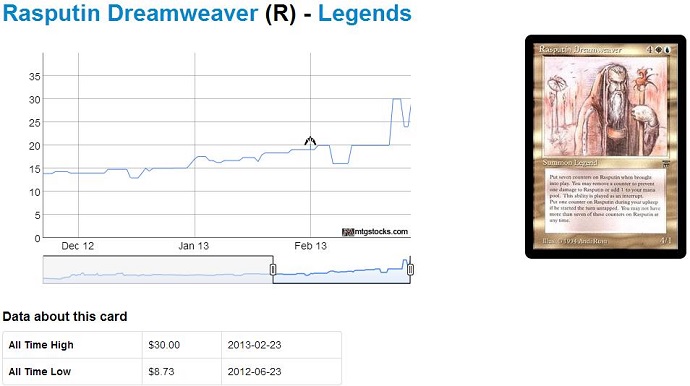

Single Card Buyers: Chains of Mephistopheles and Rasputin Dreamweaver

The reason behind the price movements on these ancient cards are perhaps the easiest to track. Neither card has started to see any tournament play, after all, so why are they suddenly jumping in value? My best guess is that each card has spiked thanks to the efforts of a single speculator.

Think about how hard it would be to buy, say, all the Hellriders in the world. Every site has dozens of them listed, and they’re going to be at least $10 each no matter where you buy them. Even if you do get every last one of them—a move that would take hundreds of thousands of dollars to pull off—more would just keep popping out of the woodwork like $18 tribbles. Previously unlisted stock from binders and local game stores would start showing up online. More product would be cracked out of packs. Buying the world out of this card would be close to impossible. Even if someone did do all of that, Wizards would likely take action with a ban or a market flood in order to dissuade anyone from trying something like that ever again.

Buying the world out of an obscure Legends rare, however, is laughably easy in comparison. Even though Chains of Mephistopheles started out as an expensive card, there simply aren’t a lot of them available to purchase at any price. You could probably start to manipulate the market with just a few thousand dollars, and once you buy out the first wave of cards, it is doubtful that too many more copies are going to show up anytime soon—people who own cards like this tend to keep them forever.

At a certain point, your actions will start to become noticed by the Magic community at large, and anyone who has ever randomly wanted a copy of this card will realize that this is their last, best chance. The last bit of your plan will be carried out by people who had nothing to do with market manipulation in the first place. And because the cards are out of print and don’t see any tournament play anyway, the chance of blowback is minimal.

How real are the price increases? This scheme only works on cards that are already incredibly rare, and it preys on the fact that cards like this haven’t really seen a price increase since Magic tripled in popularity. Of course, you still have to have demand over the long term, so chances are the price will start to fall again as speculators’ copies reenter the market.

How harmful are the price increases? These bubbles only really hurt a tiny group of people who wanted a random old card for their collections. It doesn’t make actually playing the game much popular, and it helps people who have these laying around increase the value of their collection. Overall, I doubt these cards jumping in value will drive anyone away from Magic.

What cards might jump next? Wouldn’t it be scary if someone with real purchasing power decided to buy up every Black Lotus or Mox on the market? I wouldn’t be shocked if someone tries to corner the power market at some point in the next few years.

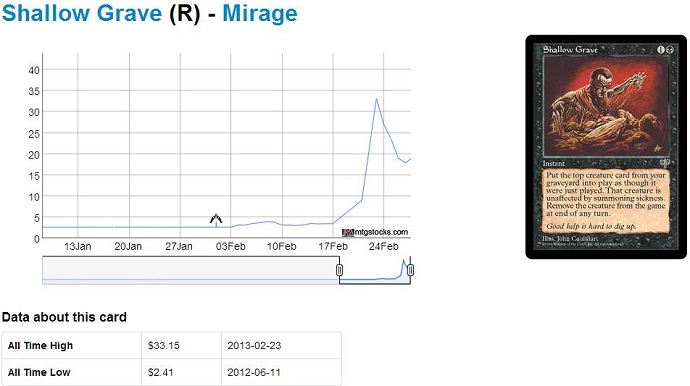

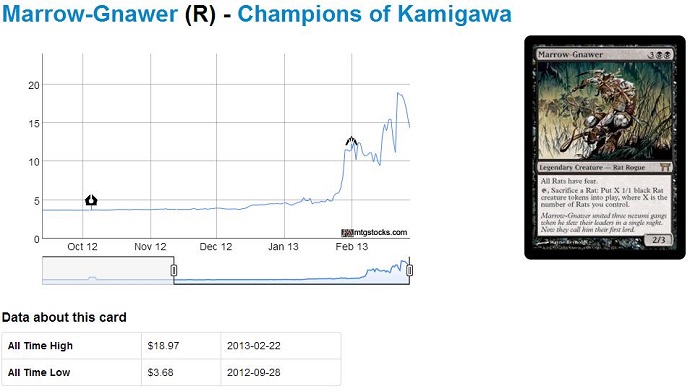

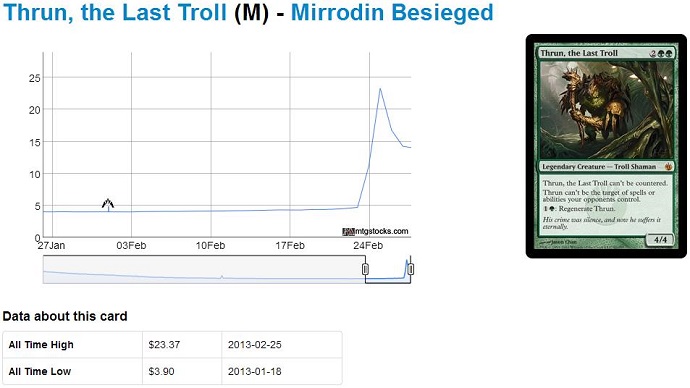

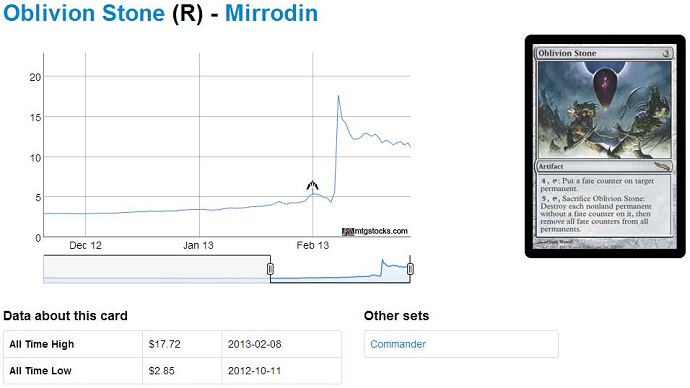

The Echo Chamber: Shallow Grave, Marrow-Gnawer, Thrun, the Last Troll, Oblivion Stone, and Greater Good

Nothing happens in a vacuum. In recent months, the Magic finance community has become far more organized and much better at disseminating information. When a card starts going up in price, my Twitter feed explodes with information. Forums and websites tell me which cards have gone up 10% in price or more over the past day. Speculators pour over decklists looking for undercosted gems. When someone comes across something and goes public with it, the price explodes in a hurry.

Think about a card like Shallow Grave. It’s from Mirage, meaning it’s old and on the reserved list. It’s good at what it does, and it has seen moderate casual play for years. When something like that shows up in a Legacy deck, alarm bells sound across the entire web. When it turns out that there are only a handful of copies available to buy because the card is so old, people freak. There’s a run on every store as hordes of speculators clamor after what they believe to be free money.

When the sellers find a few more copies and relist (and the speculators start listing), they tend to do it at a significantly higher rate in order to make sure they don’t miss out on any near future price movement. This “oh crap, I don’t want to leave money on the table” price isn’t real, of course, and over the next few days competing retails will keep dropping the price until a new equilibrium is found.

Take a look at that Oblivion Stone chart above. It spikes at $18, but it’s doubtful a single copy sold at that rate. As of now, it looks like the price is stabilizing much closer to $10. When analyzing these bubbles, it’s barely even worth mentioning what the price has “gone to” without waiting at least a week. Neither you nor anyone else will be able to sell any copies of the card at that price.

Interestingly, a lot of cards that rise in price like this have decent underlying metrics that show a card poised to gain in value anyway. Oblivion Stone is an incredibly popular casual card that started to see play as a two-of in Modern Tron. It had been between $3 and $4 forever, and it probably did deserve a little bump.

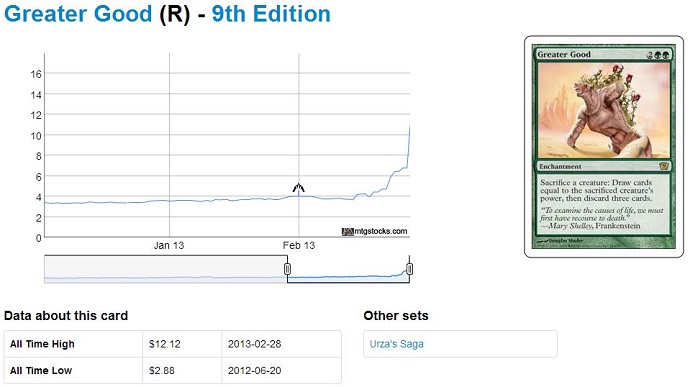

The factors that go in to which cards jump, though, are way off-kilter. Check out the following chart for Greater Good:

Greater Good has been a great casual card for years and was very stable between $3 and $4 for a long time. Over the past three days, though, it has jumped into the $15-$20 range. (Remember—these are listed prices, not actual sales data.)

Interestingly, the origins of this jump can be traced quite easily. One seller posted a copy of the card at $100 on a popular website. Most of the guides that track market fluctuations use the average value of cards listed on this site. This one outlier falsely showed the price of the card having increased by 25% or so over a one-day period, so the quick-moving speculators started buzzing about why that had occurred. When they looked at the card, they saw a Commander staple that hadn’t been printed in a long time starting to trend upward in a hurry, and they decided to buy in before it was too late.

Over the next two days, the Internet sold out of Greater Good, and those who still had copies listed them in the $15 range in order to make sure they didn’t leave any money on the table. Rinse and repeat.

I highly doubt any single person or group bought the Internet out of Marrow-Gnawer, Oblivion Stone, Shallow Grave, Greater Good, or most of the other rares that have jumped in price recently. Instead, we’ve just reached a weird place in the evolution of the Magic markets where speculators are so terrified of missing the next big thing that they jump on any card that even gives the slightest appearance of being primed for a rise. Most of these cards end up right back on the market as the speculators go for a quick flip, so they start to fall again. Rinse and repeat for a new card next week.

How real are the price increases? It depends on how much the card may have gained organically over time. In general, the “spike” price is nonsense, but these cards also rarely settle at a number as low as the original value. Oblivion Stone, for example, is currently $10 on StarCityGames.com right now. While I expect that price to keep dropping, I doubt it will go below $6 or $7 without another reprint. That’s because the card has real casual demand behind it. In the case of a card like Thrun, the Last Troll, I expect real demand for the card will eventually necessitate a price close to where he spiked—speculators have just forced the issue a little.

How harmful are the price increases? Spikes like these generally tend to hit random cards that aren’t in major decks. Chances are that you won’t need these cards on the morning of a tournament and have to pay through the nose, and casual players likely have other, cheaper options available to them. As long as you don’t need any of these cards immediately, the only time these sorts of fluctuations will hurt you is when you accidentally trade away a card you didn’t know spiked. But that’s why you read these articles and follow all the Magic finance people on Twitter, right?

What cards might jump next? There are thousands of possibilities. The other day there were some baseless rumors about the fall set using snow mana, so I made some jokes about Scrying Sheets spiking to $45. What about Mana Vault? It’s almost as good as Sol Ring in Commander, it hasn’t been reprinted in fifteen years, and it’s only $4 on StarCityGames.com. Just don’t blame me if it doubles in price tomorrow…

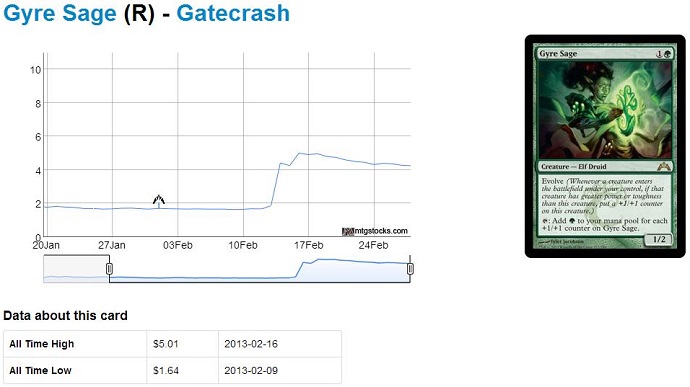

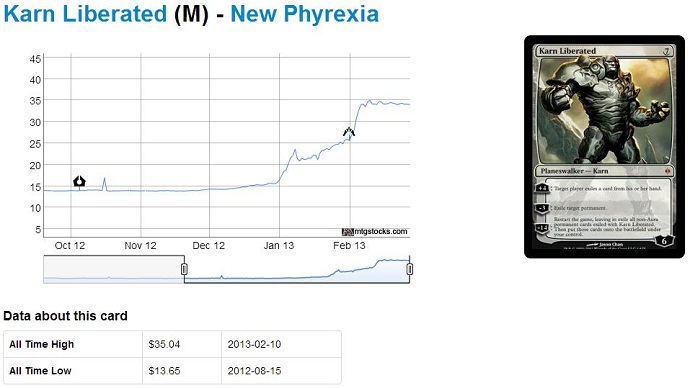

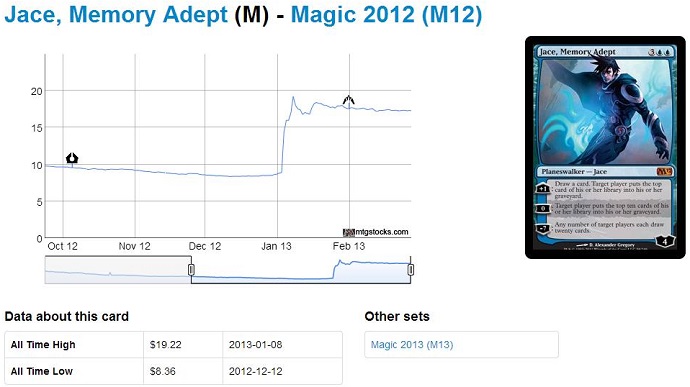

New Staples: Gyre Sage, Karn Liberated, Spellskite, and Jace, Memory Adept

Take a moment to compare the pricing charts of these four cards to the five from the previous section. Notice any differences? First, it is worth noting that Karn Liberated and Spellskite were trending upwards before the spike hit, which was presumably when the finance community at large took notice. Second, all four of these cards have stubbornly refused to fall off much from their initial spike, the prices staying close to the new level established by the jump.

Why are these four cards different? Even though the price jump was likely brought on by speculators—I personally bought in on three of these myself—all of these cards see significant play in very good decks. While some Commander players will discover Greater Good because they paid attention to the price spike, most of them already have a copy or two of this card. Most tournament players probably didn’t have the cards in this section already, so there was actual demand for them when the speculators began trying to sell off their recently acquired goods.

Why is a card like Thrun, the Last Troll in the “echo chamber” section instead of here? Currently, Thrun sees play as a one-of or two-of in a tiny handful of decks, while Spellskite sees play as a three-of or four-of in a bunch of decks. Both cards are good in Modern and will likely remain good in Modern for a while, but only one of them currently has enough demand to back up its current price.

How real are the price increases? These price increases are very real. Speculators can drive up a price in hours where it would have taken weeks before, but that doesn’t make the change in demand any less authentic. Gyre Sage may continue to trend downward a bit as more Gatecrash is opened, though.

How harmful are the price increases? Not at all. These sorts of price increases have happened in Magic since the very first pack was opened.

What cards might jump next? Angel of Serenity, Supreme Verdict, Batterskull, and Abrupt Decay are all cards I have my eyes on for various reasons.

Will the Bubbles Continue?

These sorts of single card bubbles and spikes are not unique to this period of Magic’s history. The most famous examples are probably when Modern was spoiled as a format and when Legacy prices went insane for a month a few years back. Granted, those prices spikes were more cohesive, but I still doubt “a new card hits $20 each week” is the new normal.

These sorts of spikes generally only happen in a bull market. When Magic prices are doing well, as they have historically during this time of year, buyers become concerned about missing the next big thing. Things are a little different this time around because of increased networking and a growing cohesion in the speculator community as well as an overall growth in the player base. People also underestimate just how many more people play now than when some of these cards were printed, meaning even a subtle increase in actual demand can result an in an outdated price going through the roof with a chance to stabilize at a level higher than the previous baseline value.

This summer, when Innistrad’s impending rotation starts dragging the market down, these bubbles will subside considerably. If you are interested in doing any longer term investing or you want to buy any casual cards, that will be your best chance to act.

In the meantime, I expect we may still see groups of unaffiliated but like-minded speculators buying thousands and thousands of copies of a single card. The truth is that doing this at the right time can be very profitable, even when the spec doesn’t pan out.

Let’s talk about Hall of the Bandit Lord again. I’m still not convinced a single person bought out the Internet, but it’s pretty clear that several people—possibly working together, possibly not—did purchase the lion’s share of copies. This, in turn, led to a run on the card thanks to how twitchy everyone is over missing out on value.

After a few hours where the card was “worth” $10, the bubble burst. Anyone who got in at $3-$6, hoping to cash out at $10, was likely disappointed with the fact that their investment was a total bust. However, the initial speculators, who probably bought in between $0.60 and $1, will still make a profit. As of yesterday, there were still a couple of stores paying $4 each for the card on their buylists.

This sort of market manipulation is very much like a pyramid scheme where the people at the top of the pyramid get rich while everyone else gets hosed. Because there’s no regulatory agency or body of laws governing Magic finance, though, there’s really nothing to stop these manipulations from happening other than not falling for obvious schemes that won’t benefit anyone who isn’t in on the ground floor. The only line of defense against this scummy behavior is us.

If you see a card suddenly start shooting up in price, take a moment to think before blindly buying every copy you can. Is the card part of a successful strategy, or did it just show up as a one-of in a random deck somewhere? Is it a Commander staple, or is it a weird casual card you’ve never heard of before? Had it been trending upwards already, or did it just shoot up in a straight line? I know it hurts more to miss out on a profit than to buy in on a bust, but you can’t go all-in on every hand or you’re going to go broke in a hurry. Pick your shots carefully and make them count.

This Week’s Trends

– Abrupt Decay has finally started to climb, but it’s still $8 here on StarCityGames.com. Don’t say I didn’t warn you when this card hits $15 at some point.

– Bloodhall Ooze is seeing play in Modern Jund. The card is much better without Bloodbraid Elf because it’s a poor cascade, so this might actually be a lower level format staple going forward. This previously junk rare is sold out at $3 on StarCityGames.com, and sales are in the $4 range. Pick it out of bulk boxes.

– Paradise Mantle is part of an infinite combo with Blistercoil Weird that was picked up on the mothership. This card is also sold out here at $3, and it could hit $6-$7 if the combo is a real player.

– Platinum Emperion is sold out here at $3, but did you know the card is $4+ everywhere else? This guy has been holistically trending upwards for months now and is a great trade target.

– A Dream Halls / Omniscience deck made Top 8 of a SCG Legacy event. Dream Halls is a reserved list card that could jump to $20-$30 without anyone batting an eye.

– I know I mentioned Burning-Tree Emissary last week, but let me reiterate: this card is very, very real in Eternal formats. Standard, too.

– Did you know there were two Grand Prix last week? And that one of them was the largest Magic tournament ever? Well, the other one was Standard, and some really interesting decks made Top 8 there.

The winning deck ran Frontline Medic as a four-of as well as Mayor of Avabruck. There probably isn’t room for the Mayor to rise in value, at least not yet, but this is the first event where Frontline Medic proved it deserves to be ranked among the highest priced cards in Gatecrash.

Human Reanimator also showed up, as well as Jund Zombies, more Naya, The Aristocrats, and a whole pile of regular Jund. Huntmaster of the Fells was absolutely everywhere, and Boros Reckoner was only in one Top 8 deck.

Looking for an intriguing spec pickup from the weekend? How about Lotleth Troll? StarCityGames.com has ’em retailing for just $2, down from the $10+ it was preselling at a few months ago. It may never be a powerhouse, but it did make Top 8.

Other odd cards in the Top 8 included Wolfbitten Captive, Undercity Informer, a pile of Fiend Hunters, Murder, Dead Weight, Staff of Nin, and Giant Growth(!!) in the winning deck.

Until next time –

– Chas Andres